N.B. : I am a Bitcoiner. So this post is me steelmanning the case for Ethereum's electricity consumption vs that of Bitcoin.

While I will not put .eth to my name, there is a case to be made for the market's growing interest in the Ethereum protocol.

Enjoy.

From climate control to training AIs to running blockchains, big tech industries are in a deep fight for electricity.

Not least is Ethereum and Bitcoin.

In the first round, Ethereum won the energy efficiency battle when it moved to Proof of Stake.

Can Bitcoin throw a counterpunch?

Could Ethereum throw the KO?

PoS electricity saving vs PoW electricity guzzling

Let us recap Ethereum's first win in this energy battle with the switch to a proof-of-stake system.

Essentially, PoS incentivizes Ethereum hodlers to mine coins equivalent to the size and time-length of their hodl.

While Ethereum rewards its hodlers, Bitcoin's PoW system rewards Energy guzzlers.

But Earth has a tricky energy budget it hands to humans, with a lot of negative externalities everywhere.

We can't just guzzle energy like a kid on its mother's tit.

Rewarding hodlers seems like a fishy double reward at first (staked ether goes up in price, and they also get more ether tokens mined) but if electricity supply ever became a problematic deal on this our good Earth (courtesy of climate change and stuff), then Ethereum will still be singing long after Bitcoin has gone quiet from a 'heat death'’

I pray we do not have to choose between TV and Bitcoin mining. Because we will choose ease.

We are humans.

We shall choose the former.

Then Bitcoin mining, hence Bitcoin, will likely crash way below Ethereum's price value for a while (really?!).

Worse, if Bitcoin mining has to interrupt AI while that creature is training.

Yeah, that punch will hurt.

Ethereum 1 : 0 Bitcoin.

Bitcoin's Layer 2 Lightning Network to Its Rescue

Ethereum's multiple decentralized communes, scalability and wrappability onto multiple tokens, and security features including roll-back mining, together, are besting Bitcoin.

But not the Bitcoin Lightning Network.

Yup. Sad truth.

The LN has the one powerful tool in its arsenal coveted by all fintech -- Speed.

Speed is a #1 value in the financial markets.

Speedy spot trades on fast internet could mean the difference between making $1 million and losing $1 million.

Bitcoin is The Flash.

Nobody is trying to compete with the Bitcoin lightning network (LN).

They'd be left in the dust. Holding an empty bag.

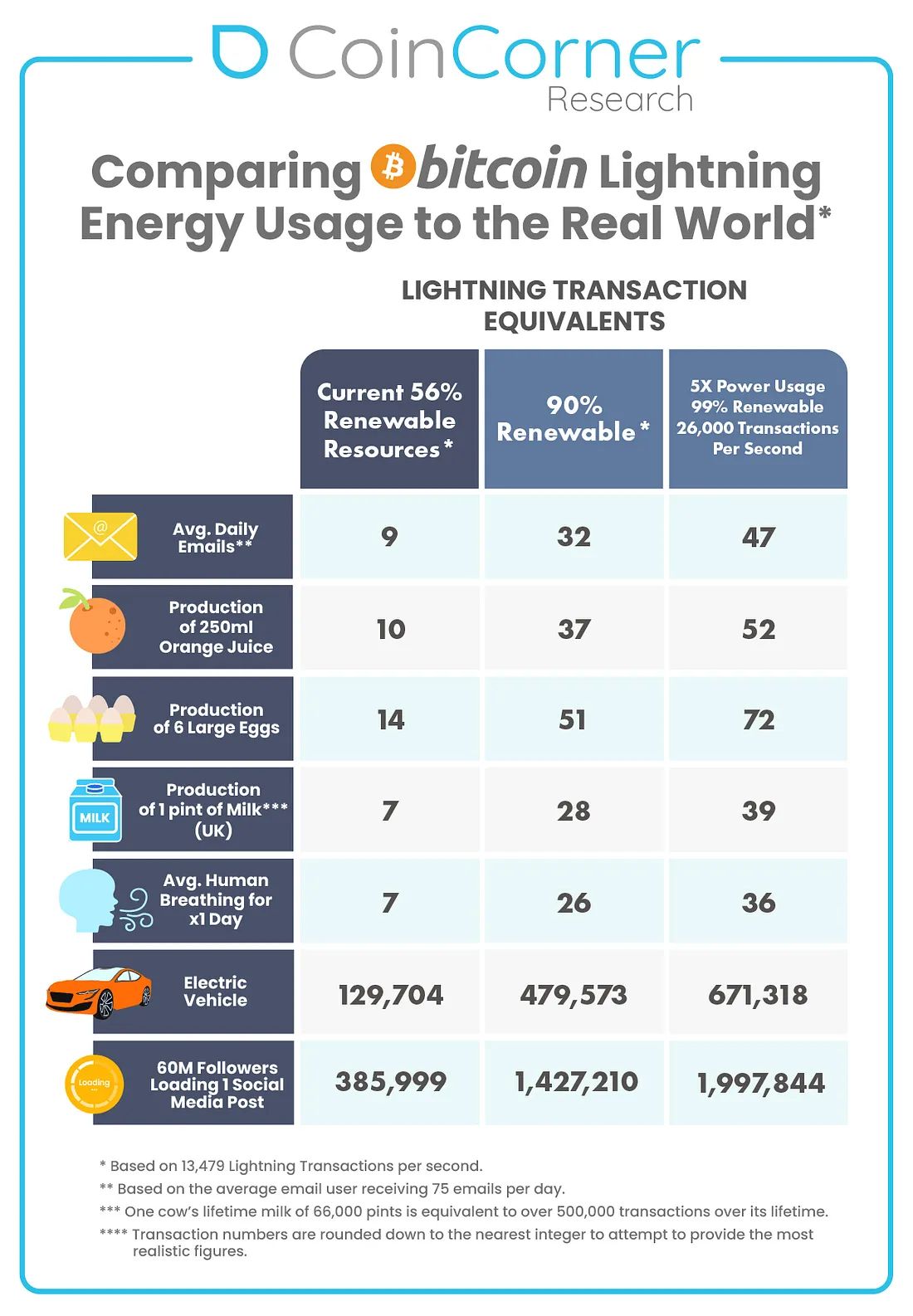

While the electricity costs of running the Bitcoin LN are not inconsequential, they are very small.

What can I say? Bitcoin won this round.

Ethereum 1: 1 Bitcoin.

When Ethereum meters Bitcoin's energy, and then some

Ethereum has way better smart contracts than Bitcoin, which has primitive contractual abilities.

If Bitcoin is a contractual calculator with +×÷=, Ethereum is a contractual supercomputer.

Ethereum is so good that an entirely new blockchain called the Internet Computer Protocol / ICP was built on top of it.

The ICP is unique in that it has a reverse gas fee model for executing smart contracts.

Bottom line, zero fees can be paid for high-level smart contracts.

These ultra-cheap smart contracts could be used to track Bitcoin's energy consumption, and even the energy consumption of AI and Quantum Computers!

Yeah, Ethereum is on a roll.

EVM and BitVM. Potato Potato

EVM

Ethereum's Virtual Machine (EVM) inspired the creation of the Bitcoin Virtual Machine (BitVM) computational protocol.

Which is interesting because Ethereum was chipped out of Bitcoin, and now later, new Bitcoin tools are being chipped out of Ethereum.

Who would have thought?

Turns out people love Ethereum smart contracts. So much so that Rootstock, a Bitcoin sidechain, has raised north of $580 million dollars from nearly 3000 BTC staked into the project by investors, big and small, all from providing EVM smart contracting capabilities compatible with Bitcoin.

Wrapped Bitcoin

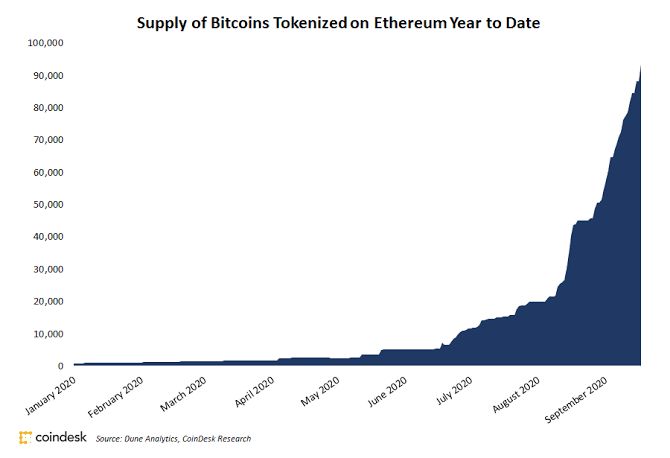

Wrapped Bitcoin (WBTC), an ERC20 token (meaning it lives on the Ethereum blockchain), boasts a liquidity of $10 billion dollars and has grown exponentially over the past three years, with a trend that was firmly set in 2020.

All this trend means one thing.

Hodling BTC in a cold wallet is nice and dandy. But human beings are not hibernating bears.

Human beings wanna play, experiment, tweak.

We enjoy wrapping our Bitcoin in Ethereum smart contracts. We dare break Bitcoin with utility hacks.

If it really is a Phoenix and not some fragile cryptographic King of tech, then it shall take it.

Bitcoin's insurance policy

It has been said that bitcoins cannot be insured. Wrong.

If Bitcoin ever got hurt for any reason, perhaps because all the mining equipment has been starved of energy in some abrupt ice age,

perhaps because too many of the 21 million coins get lost courtesy of an AI trick,

Ethereum will nurse it back to life.

Ethereum is Bitcoin's insurance policy.

Ethereum has the tools to keep the Bitcoin train running as smoothly as the Hogwarts Express.

Ethereum has the tools to build a bigger, better, badder train. Like fr. No hard feelings required.

There is a second best.

***

Ethereum wins this Battle.

Electrical energy used --> Negligible.

Conclusion

Ethereum is the #1 cryptocurrency in smart contracts, so much so that its protocol suite has been borrowed a few times for utility on the #1 blockchain - Bitcoin.

While people might not trust Ethereum's tokenomics, they can trust its smart contracts as the best in the blockchain game.

The numbers have spoken for themselves.

One might say, “But Ethereum’s currency is inflationary, and I prefer PoW”. However, a mutable and evolving currency is also the fuel for cheap smart contracts.

It’s like cheap paper for people to write out paper contracts. It is in plenty.

Bitcoin is the best money and the best asset imho.

But if you want to build the finest smart contracts for blockchain, you might want to check out Ethereum, its derivative chains and ongoing projects.

See you out there anon.

Keep hodling,

Keep buidling,

Keep transacting,

Love and Peace.