Let's learn about Trading via these 268 free stories. They are ordered by most time reading created on HackerNoon. Visit the /Learn Repo to find the most read stories about any technology.

You’re most likely looking at crypto trading related articles right now, no? But occasionally the community may surprise you with something more traditional.

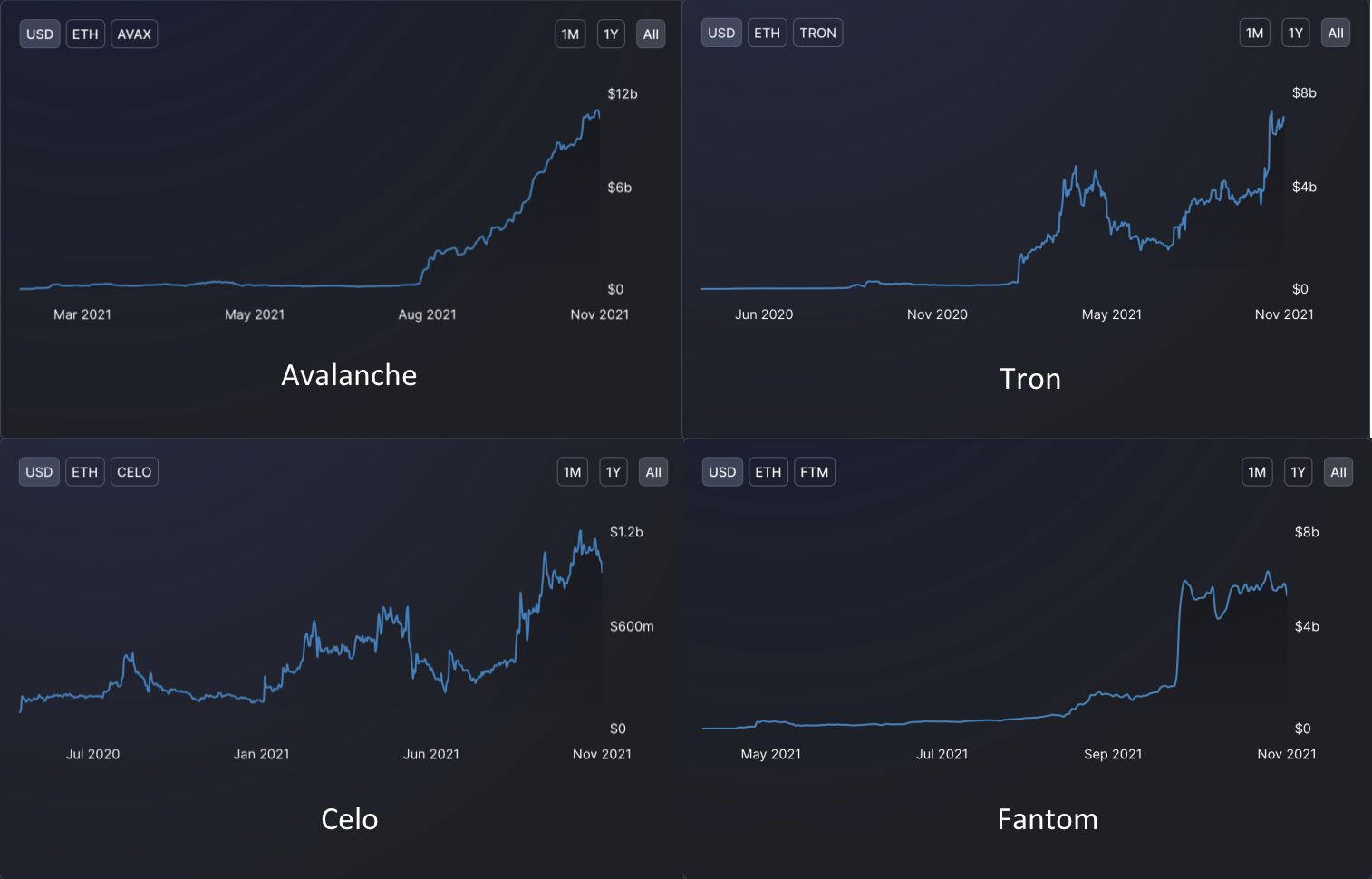

1. CEXs Vs. Bridging Vs. Multi-chain AMMs Vs. Intermediate Tokens: The 4 Ways For Cross-Chain Liquidity

A brief summary of different cross-chain approaches for beginners and non-techers who want to transfer assets from one Blockchain to another with ease.

A brief summary of different cross-chain approaches for beginners and non-techers who want to transfer assets from one Blockchain to another with ease.

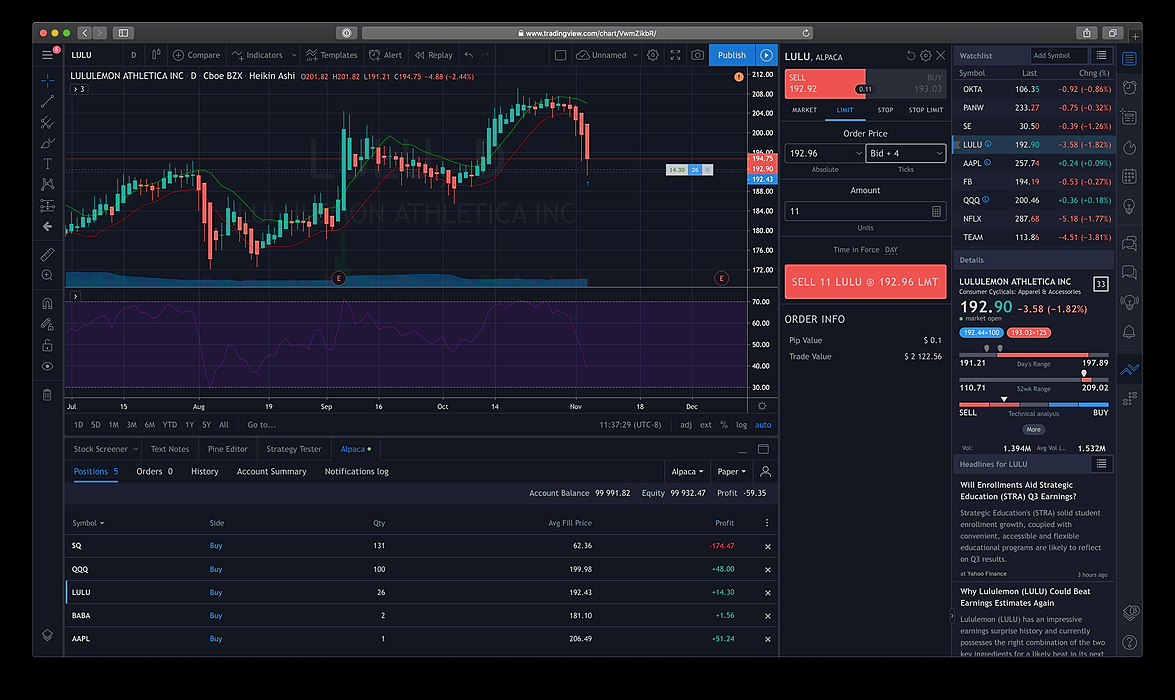

2. What You Should Know to Win at Algorithmic Trading

Among all the trading techniques, one of the most popular and sophisticated is algorithmic trading.

Among all the trading techniques, one of the most popular and sophisticated is algorithmic trading.

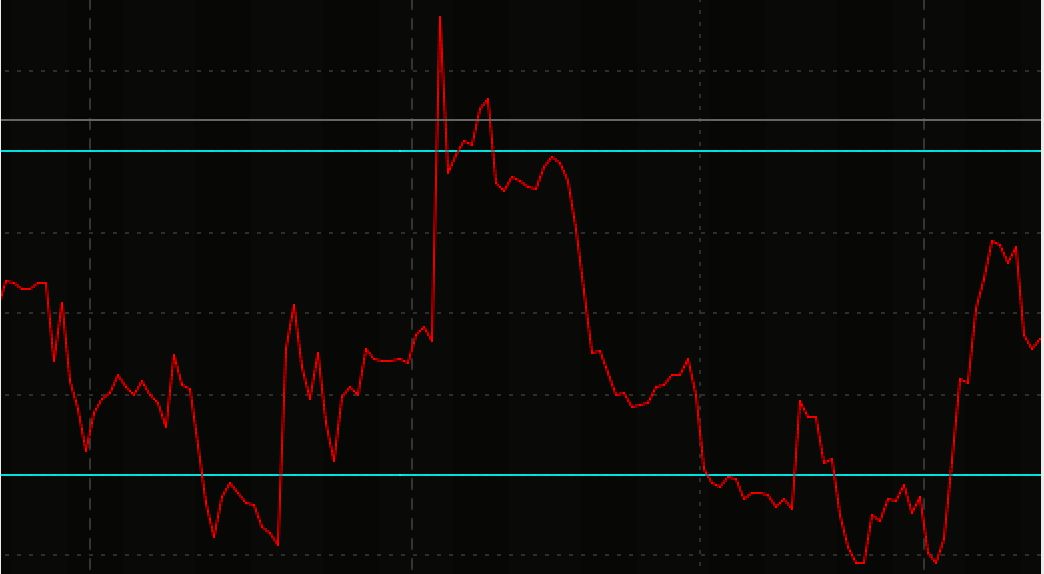

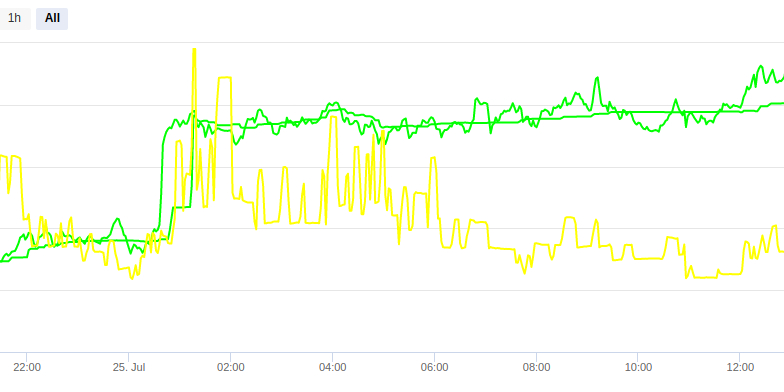

3. Should Crypto-Prices Converge If One Exchange Has Positive Funding Rate While Another Has Negative?

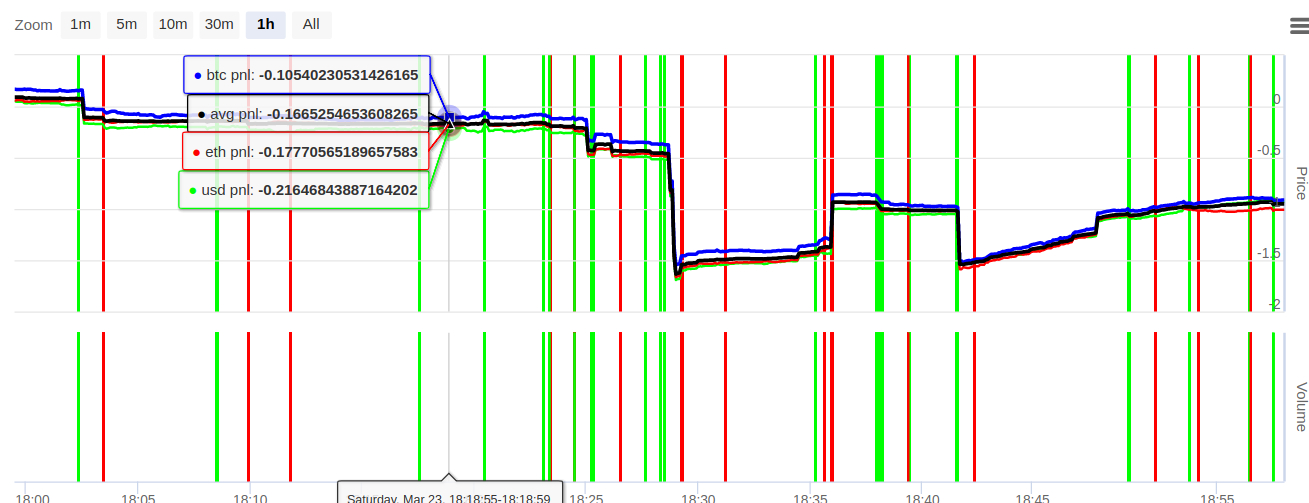

I was revisiting the theory behind Deribit/Bitmex/Bybit ETH/BTC funding rate arbitrager. Given the theory behind funding rates, if one exchange has a negative rate while another has positive it should mean that the prices converge.

I was revisiting the theory behind Deribit/Bitmex/Bybit ETH/BTC funding rate arbitrager. Given the theory behind funding rates, if one exchange has a negative rate while another has positive it should mean that the prices converge.

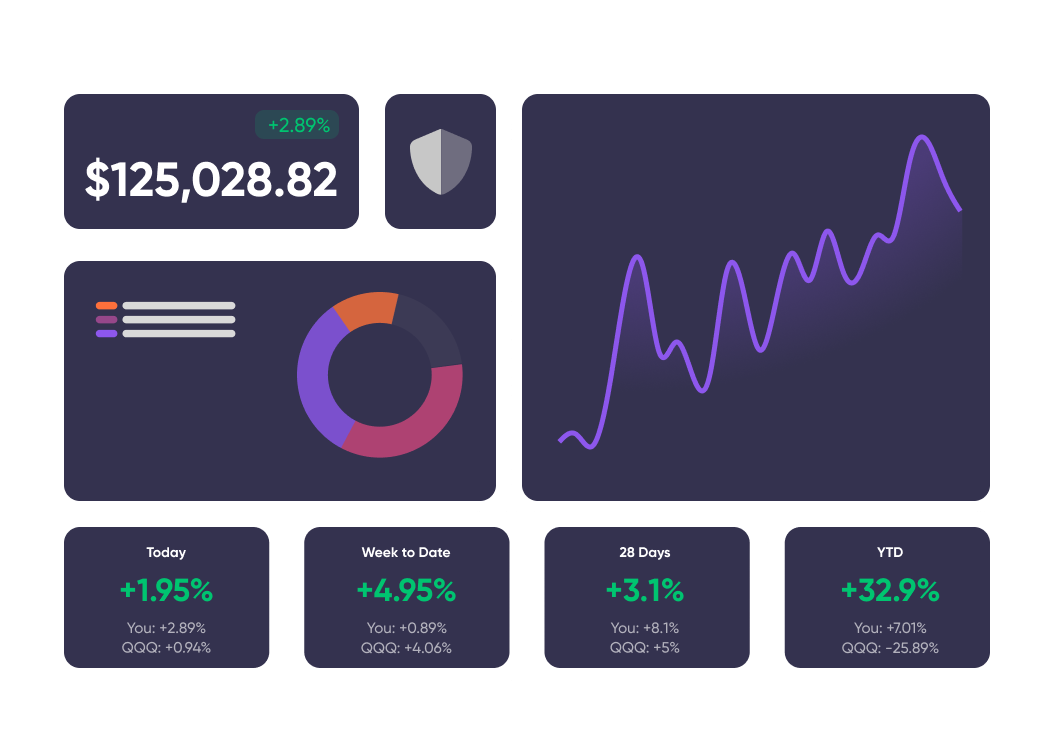

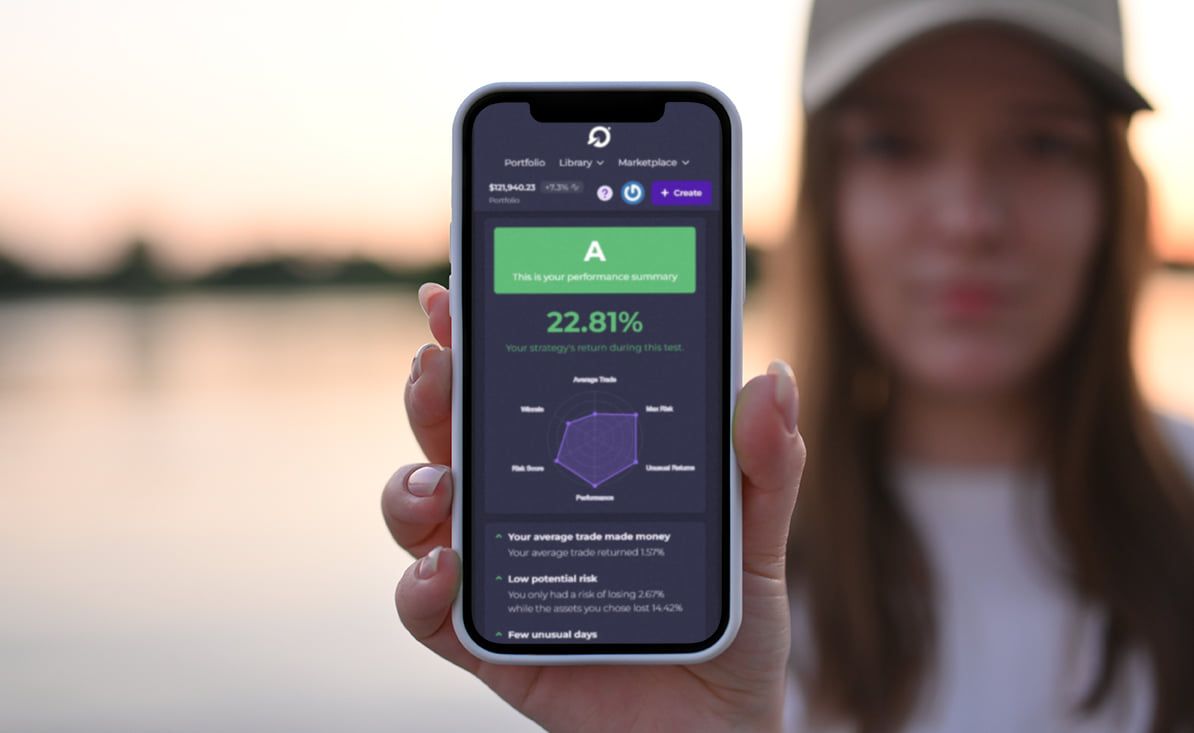

4. Q&A with Pluto Co-Founder and CEO Jacob Sansbury

Q&A with Pluto Co-Founder and CEO Jacob Sansbury

Q&A with Pluto Co-Founder and CEO Jacob Sansbury

5. Retail Trading Tech Trends, the Positive Impacts, and More

Pluto is democratizing finance and aims to shift power from Wall Street back into the hands of retail investors.

Pluto is democratizing finance and aims to shift power from Wall Street back into the hands of retail investors.

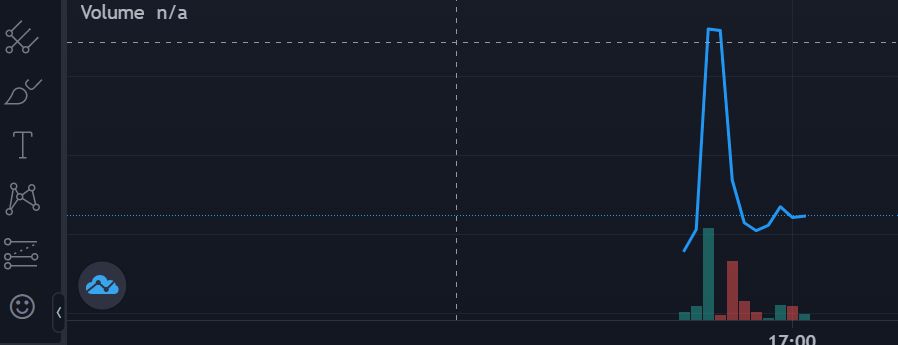

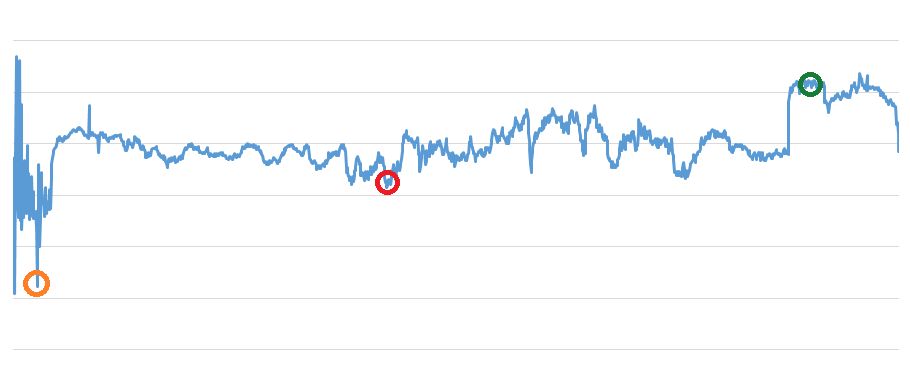

6. How Smart Money Influenced LAZIO's Price

The whole world is eagerly awaiting the World Cup and Fan Token is the top target for price pumping. So there we have it - an analysis of LAZIO.

The whole world is eagerly awaiting the World Cup and Fan Token is the top target for price pumping. So there we have it - an analysis of LAZIO.

7. Crypto-Trading with Ichimoku Cloud...And The World of Virtual Trading Assistants

Crypto enthusiasts often face a conundrum when turning to cryptocurrency as a viable investment. An eternal question remains: To invest and forget, or to trade the notorious price swings for even more gains?

Crypto enthusiasts often face a conundrum when turning to cryptocurrency as a viable investment. An eternal question remains: To invest and forget, or to trade the notorious price swings for even more gains?

8. A Dash Primer - Digital Cash You Can Spend Anywhere

"The Dash Platform has the potential to rule them all." This statement by Dash Product Owner, Dana Alibrandi, hints to the value that the platform provides in the cryptocurrency space. On Thursday, May the 23rd, Blockchain at UCLA hosted Dana Alibrandi for their first event of the spring to about what Dash is, how the platform works, and its potential use cases.

"The Dash Platform has the potential to rule them all." This statement by Dash Product Owner, Dana Alibrandi, hints to the value that the platform provides in the cryptocurrency space. On Thursday, May the 23rd, Blockchain at UCLA hosted Dana Alibrandi for their first event of the spring to about what Dash is, how the platform works, and its potential use cases.

9. Battle of the Automatic Trade Signal Execution Architectures: 3Commas, Alertatron, Plurex

You want Automatic Execution that suits the needs of your Trading Bot. A comparison of 3Commas, Alertatron and Plurex architectures and their pros and cons.

You want Automatic Execution that suits the needs of your Trading Bot. A comparison of 3Commas, Alertatron and Plurex architectures and their pros and cons.

10. Boost Your Trading Performance With Commissions

How to boost your trading performance: Commissions

How to boost your trading performance: Commissions

11. How to Profit from a Trailing Stop Loss on Binance

This is part of an ongoing series where I dive deep into Binance and show you how to get the most out of the exchange.

This is part of an ongoing series where I dive deep into Binance and show you how to get the most out of the exchange.

12. Information Asymmetry and Crypto Trading

Information Asymmetry is what attracts poker, chess and videogames players into crypto and trading.

Information Asymmetry is what attracts poker, chess and videogames players into crypto and trading.

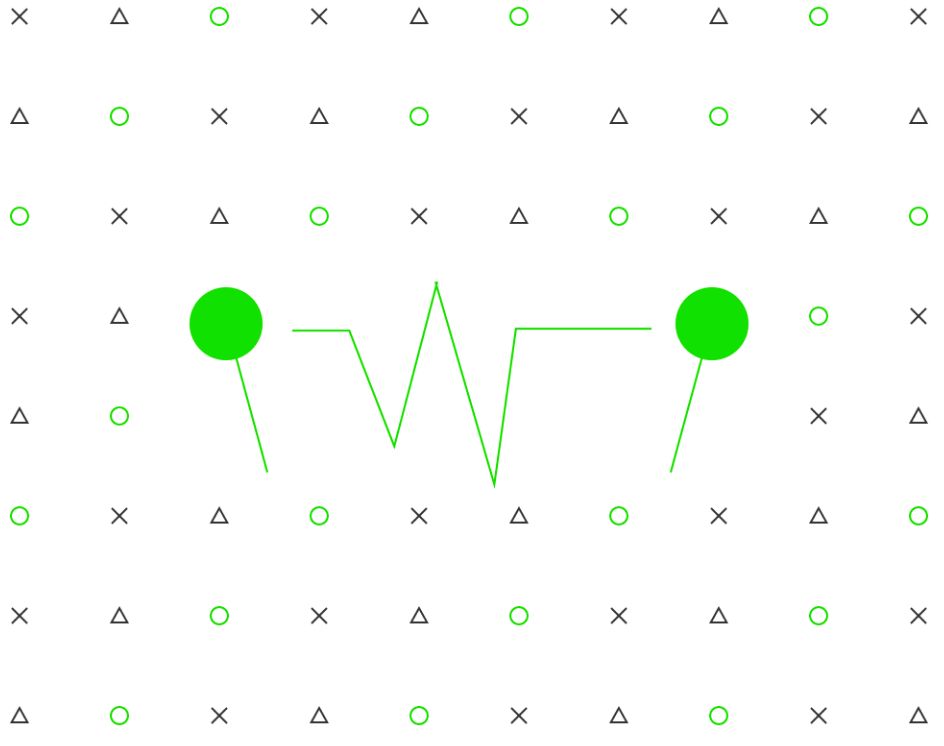

13. Trading Range: Finding Your Next Runners

Ask traders how they find the next breakout move, the next runner that’s going to skyrocket to +2000% profit. They’ll likely spout a bunch of technical indicators, screeners, Bollinger Bands, RSI, Stochastic Indicators… the list could go on. Before we even get to these tools, we first need to understand what the stock is breaking out from. So without further ado, here is your lesson on Trading Range.

Ask traders how they find the next breakout move, the next runner that’s going to skyrocket to +2000% profit. They’ll likely spout a bunch of technical indicators, screeners, Bollinger Bands, RSI, Stochastic Indicators… the list could go on. Before we even get to these tools, we first need to understand what the stock is breaking out from. So without further ado, here is your lesson on Trading Range.

14. Is Tether A Reliable Stablecoin Or Is It A High-risk Asset?

The key to success for any trader is asset diversification and systematic control over them

The key to success for any trader is asset diversification and systematic control over them

15. How Does A Bitcoin Over The Counter (OTC) Market Work? [Explained]

Everybody involved in the crypto ecosystem knows the importance of crypto exchanges. Often times, the CEOs of these exchanges are seen as the rockstars of the modern finance world — yet nobody seems to know about and completely understand the importance of the OTC market.

Everybody involved in the crypto ecosystem knows the importance of crypto exchanges. Often times, the CEOs of these exchanges are seen as the rockstars of the modern finance world — yet nobody seems to know about and completely understand the importance of the OTC market.

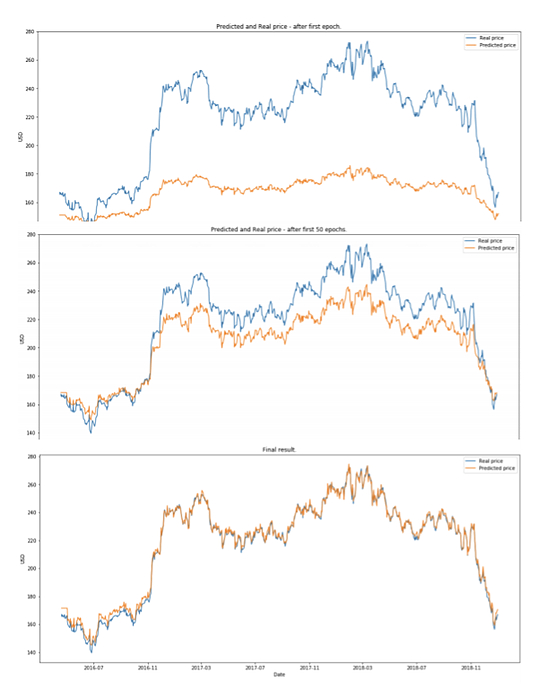

16. 3 Trends of the Neural Network Usage for Algorithmic Trading

Developers of AI systems can create complex algorithms for a wide range of use cases, including in investing and trading.

Developers of AI systems can create complex algorithms for a wide range of use cases, including in investing and trading.

17. An Introduction to Relative Strength Index Trading Strategies

Relative Strength Index (RSI) is another staple indicator of the technical analysis world. What is the Relative Strength Index? It measures the speed and change of price movements to evaluate if a stock is overbought or oversold. A wildly popular tool among traders, it is also widely misunderstood.

Relative Strength Index (RSI) is another staple indicator of the technical analysis world. What is the Relative Strength Index? It measures the speed and change of price movements to evaluate if a stock is overbought or oversold. A wildly popular tool among traders, it is also widely misunderstood.

18. How to Earn Profit on Crowd-sourced Automated Trading Communities

19. The Ultimate Guide To Successful Algorithmic Trading

Photo From UnSplash

Photo From UnSplash

20. Grayscale's (GBTC) Pump Effect Means 2021 Will Start Slow

let's look at what Grayscale is, what this 'pump effect' is, and why it might create sagging prices over the holidays.

let's look at what Grayscale is, what this 'pump effect' is, and why it might create sagging prices over the holidays.

21. 3 Most Undervalued Chinese Stocks

The Chinese stock market is not a place for the faint of heart but that does not mean that you should ignore it.

The Chinese stock market is not a place for the faint of heart but that does not mean that you should ignore it.

22. A Successful Forex Plan Is Within Your Grasp

While the potential for profits is large when trading with forex, it is important to learn about it first. The following information can help you in some of the demo account well.

While the potential for profits is large when trading with forex, it is important to learn about it first. The following information can help you in some of the demo account well.

23. Mean Reversion Trading Systems and Cryptocurrency Trading [A Deep Dive]

24. How To Get Market Cipher Indicators For Free and Use Them To Crush The Market

The 3 of the most coveted indicators for crypto are now live on Aurox.. For FREE! These indicators cost a whopping $1500 but free on Aurox.

The 3 of the most coveted indicators for crypto are now live on Aurox.. For FREE! These indicators cost a whopping $1500 but free on Aurox.

25. Virtual Futures: How We "Copied" Financial Markets on Ethereum

Find out how we used Ethereum to create Morpher, a trading app that has “virtual copies” of over 700 markets on the blockchain, from Apple stocks to gold.

Find out how we used Ethereum to create Morpher, a trading app that has “virtual copies” of over 700 markets on the blockchain, from Apple stocks to gold.

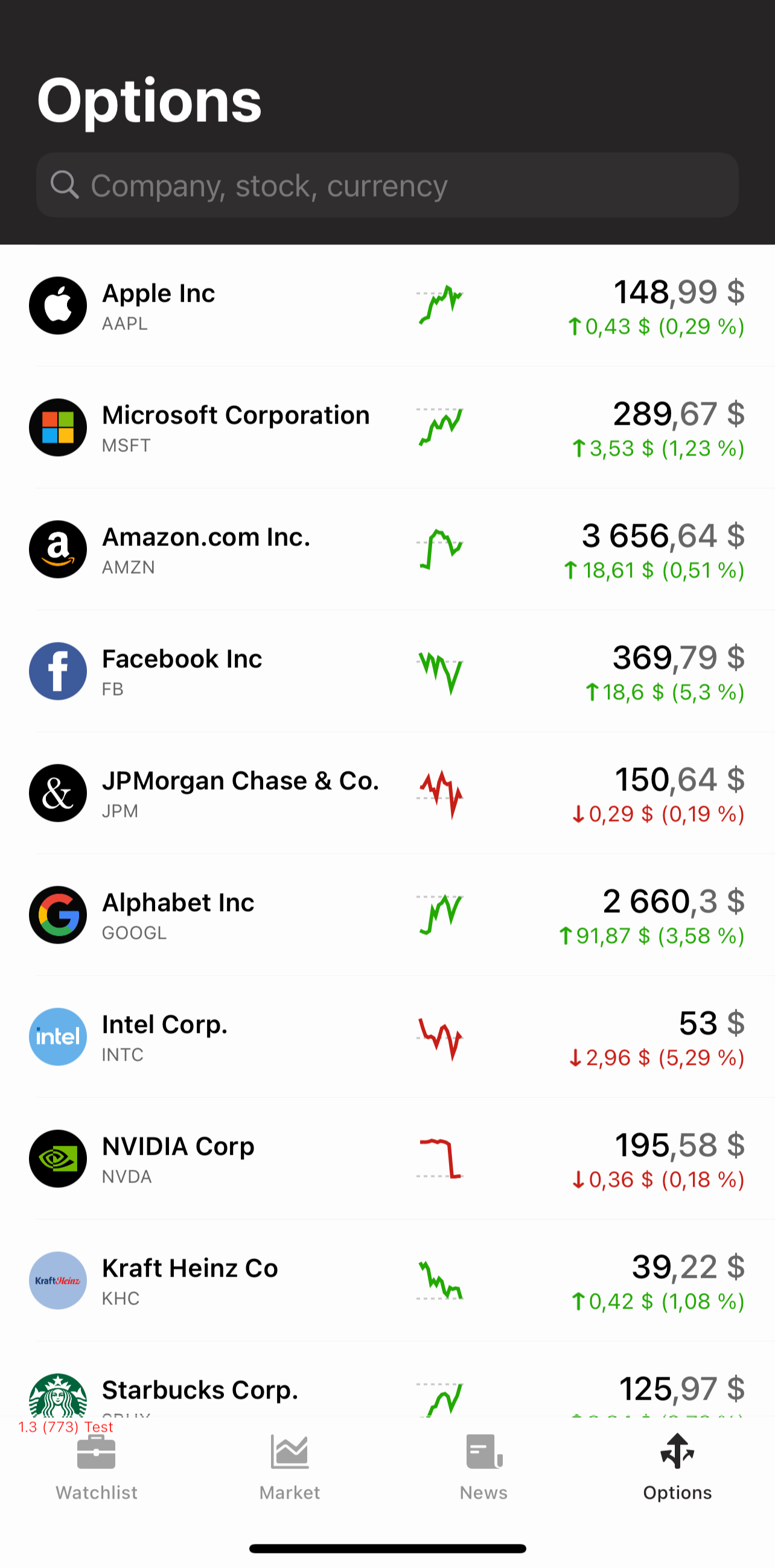

26. Understanding Stock Options

Stock Options are one of the most misunderstood investment instruments available on the stock market. Just mention ‘Stock Options’ to everyday investors, and you’re bound to hear such misnomers as — “they’re too risky”, “they’re too complicated”, and “isn’t it just gambling?”

Stock Options are one of the most misunderstood investment instruments available on the stock market. Just mention ‘Stock Options’ to everyday investors, and you’re bound to hear such misnomers as — “they’re too risky”, “they’re too complicated”, and “isn’t it just gambling?”

27. Trading Crypto in 2021: How to Switch to Polygon & Avoid the Ethereum Traffic Jam

Avoid crippling gas fees! Learn how to transfer your tokens from the Ethereum to Polygon blockchain, so you can trade at a fraction of the cost and speed.

Avoid crippling gas fees! Learn how to transfer your tokens from the Ethereum to Polygon blockchain, so you can trade at a fraction of the cost and speed.

28. How To Maximize Your Arbitrage Trading Profits In 2020

Arbitrage is simple. Due to market inefficiencies, the same asset could be priced differently across the exchange. Therefore, you can buy an asset in one market and simultaneously sell it in another market at a higher price for profit. While considered to be a risk-free profit trading strategy, it’s almost impossible to execute manually as the key here is “simultaneously”.

Arbitrage is simple. Due to market inefficiencies, the same asset could be priced differently across the exchange. Therefore, you can buy an asset in one market and simultaneously sell it in another market at a higher price for profit. While considered to be a risk-free profit trading strategy, it’s almost impossible to execute manually as the key here is “simultaneously”.

29. An Introduction to Binance Margin Trading and How it Works

It is no news that the cryptocurrency space is very volatile. For instance, no one expected Bitcoin to quickly rise from less than $20,000 to over $23,000 in less than 24 hours on December 17, 2020.

It is no news that the cryptocurrency space is very volatile. For instance, no one expected Bitcoin to quickly rise from less than $20,000 to over $23,000 in less than 24 hours on December 17, 2020.

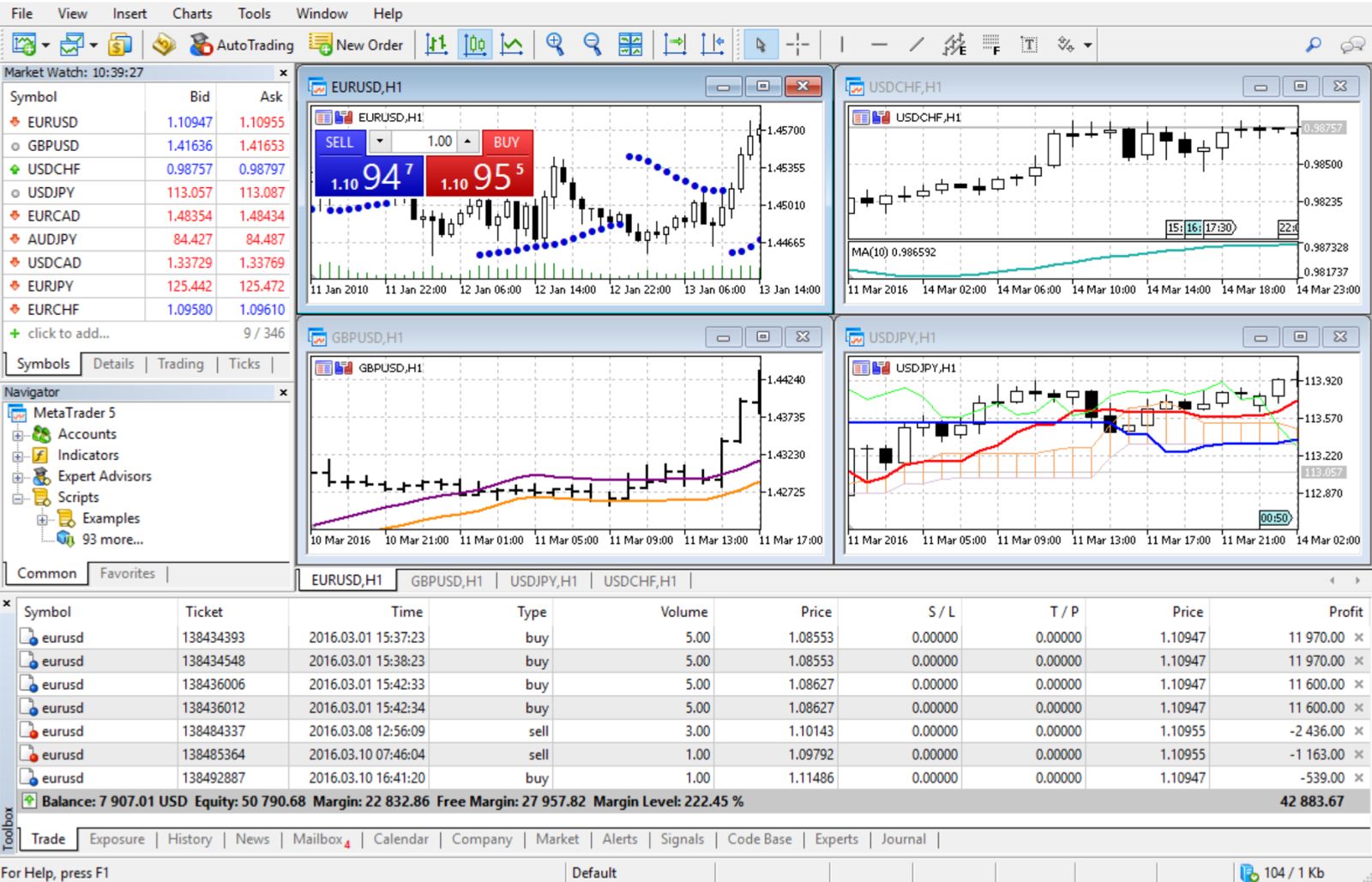

30. Automated Trading - What, How, and Why?

Automatic trading is a very useful addition to the trader’s arsenal. Back in the 2000s when trading just became available for average people with the development of the MetaTrader 4 platform there were not many options to automate the process.

Automatic trading is a very useful addition to the trader’s arsenal. Back in the 2000s when trading just became available for average people with the development of the MetaTrader 4 platform there were not many options to automate the process.

31. A Quick Guide to Automated Bot Trading

32. How to Think Like a Winner: Developing a Growth Mindset

People often perceive changes and challenges as threats. When a threat is present, a person’s ability to think, learn, adapt, and recover is limited.

People often perceive changes and challenges as threats. When a threat is present, a person’s ability to think, learn, adapt, and recover is limited.

33. In-Game Asset Trading on the Blockchain

Hosting in-game assets on the blockchain would open countless doors in the world of video game asset trading and ownership. It's not a matter of if, but when.

Hosting in-game assets on the blockchain would open countless doors in the world of video game asset trading and ownership. It's not a matter of if, but when.

34. Creating a Crypto Terminal for macOS: Lessons Learned From Expanding Our Product Ecosystem

How we decided to build the best-ever crypto trading terminal for macOS to make technical analysis and scalping easier

How we decided to build the best-ever crypto trading terminal for macOS to make technical analysis and scalping easier

35. Startup Interview with Denis Vasilev, LAVA's Founder

LAVA was nominated as one of the top startups in Moscow in Startups of the year hosted by HackerNoon. This is an interview with its founder.

LAVA was nominated as one of the top startups in Moscow in Startups of the year hosted by HackerNoon. This is an interview with its founder.

36. Fintech-Populism: Using Technology to Level the Financial Playing Field

The solution to investing inequality is simply to build trading algorithms for the people.

The solution to investing inequality is simply to build trading algorithms for the people.

37. A Week to Forget About Inflation

The Black Friday Sale with discounts of up to 60% starts on Tradingview.

The Black Friday Sale with discounts of up to 60% starts on Tradingview.

38. Dividends vs. Trading Profits

Before starting your crypto journey first learn which one is better than between dividends or trading profits. Which one easier or less risky.

Before starting your crypto journey first learn which one is better than between dividends or trading profits. Which one easier or less risky.

39. Despite the Bearish Sentiment, There are Still Ways to Make Quick Gains with IDOs

There are still ways to make quick gains in the crytpo market with IDOs despite the market being bearish in the last few months thanks to disruptions.

There are still ways to make quick gains in the crytpo market with IDOs despite the market being bearish in the last few months thanks to disruptions.

40. 3 Things Not to Do When Bitcoin is Going Down

Photo by Ian Stauffer on Unsplash

Photo by Ian Stauffer on Unsplash

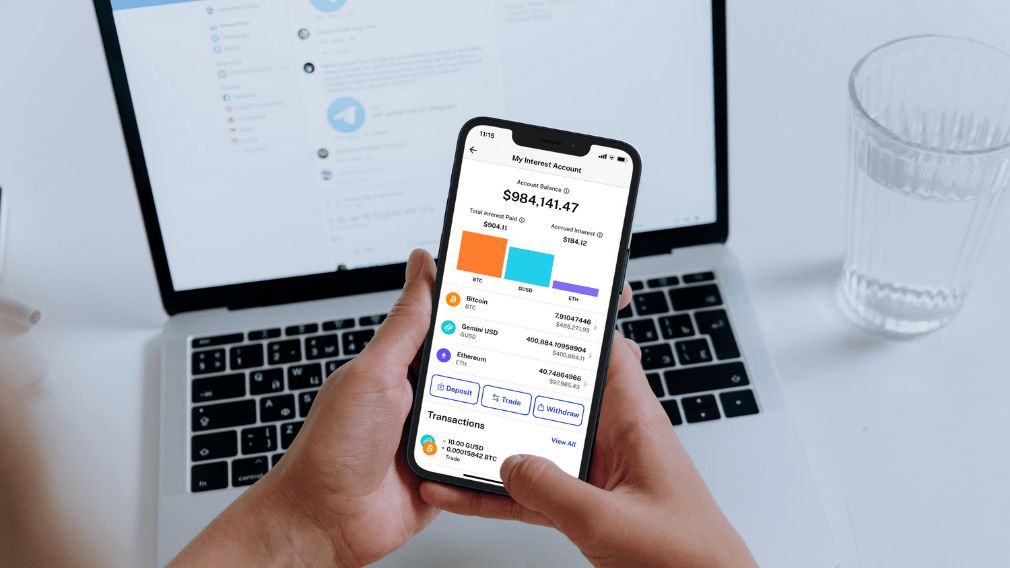

41. A Beginner’s Guide to Trading on Gemini Exchange

42. Better Technical Analysis with Blockchain Indicators: Bollinger Bands

43. How Can SEO for Forex Companies be Useful and Profitable?

Companies may improve their search engine results by obtaining high-quality links from other websites or obtaining backlinks that lead to their own site

Companies may improve their search engine results by obtaining high-quality links from other websites or obtaining backlinks that lead to their own site

44. How to Create an Account on Binance and Begin Trading Digital Assets

In this article, we will go through a step-by-step process of opening a Binance account for cryptocurrency trading.

In this article, we will go through a step-by-step process of opening a Binance account for cryptocurrency trading.

45. MEXC Global’s Record Low Fees Boosts Crypto Market Recovery

Ever since MEXC Global announced it was slashing maker and taker fees on the platform, the exchange has seen renewed growth.

Ever since MEXC Global announced it was slashing maker and taker fees on the platform, the exchange has seen renewed growth.

46. How to Correctly Locate The RSI Support and Resistance levels of Traded Entities

RSI or Relative Strength Index is one of the most common indicators when charting financial assets. In short the RSI shall give an indication whether an asset is overbought or oversold.

RSI or Relative Strength Index is one of the most common indicators when charting financial assets. In short the RSI shall give an indication whether an asset is overbought or oversold.

47. The Smart New Tools Powering The Crypto Trading Boom

The Smart New Tools Powering The Crypto Trading Boom

The Smart New Tools Powering The Crypto Trading Boom

48. abc

- Introduction

49. 3 Types of Crypto Investors: Which Strategy Wins?

Having a plan in place helps to avoid mistakes that can result in large losses.

Having a plan in place helps to avoid mistakes that can result in large losses.

50. Introducing Nova Finance

Nova is an inclusive portfolio management platform that harnesses the power of programmable assets built on Solana.

Nova is an inclusive portfolio management platform that harnesses the power of programmable assets built on Solana.

51. How to Make Money in a Falling Market

The best way not to lose but also to make money in a falling market is to hedge your purchases with short positions on a margin platform.

The best way not to lose but also to make money in a falling market is to hedge your purchases with short positions on a margin platform.

52. Applying Statistical Analysis to Intraday Forex Trading Using SQL

Statistical Analysis, Intraday Forex Trading, Using SQL

Statistical Analysis, Intraday Forex Trading, Using SQL

53. Crypto Market Making Explained: The Secret Keystone To A Token Project's Success

Even highly liquid markets experience high volatility. Crypto market making is, therefore, an essential element for any token project.

Even highly liquid markets experience high volatility. Crypto market making is, therefore, an essential element for any token project.

54. Crypto Trading on Centralized vs. Decentralized Exchanges

On a centralized exchange, users do not have control over their funds, as they are stored on the exchange's servers.

On a centralized exchange, users do not have control over their funds, as they are stored on the exchange's servers.

55. The Future of Cryptocurrency Trading

Cryptocurrency is one of the most in-demand assets to have in your portfolio right now.

Cryptocurrency is one of the most in-demand assets to have in your portfolio right now.

56. 3 Ways To Trade Altcoins In 2019

Sharing the trade-offs between each method of trading

Sharing the trade-offs between each method of trading

57. Is Technical Trading Cryptocurrencies A Profitable Exercise [Analyzed]

In two ongoing examinations, I explored the specialized exchanging rules the digital currency market and gainfulness of specialized exchanging rules among cryptographic forms of money with a protection work.

In two ongoing examinations, I explored the specialized exchanging rules the digital currency market and gainfulness of specialized exchanging rules among cryptographic forms of money with a protection work.

58. An Overview of 4 Exchange Tokens: Binance, Coinsbit, EXMO, Huobi

The year 2019 has given a whole new meaning to the cryptocurrency sphere. From Facebook announcing its own cryptocurrency project ‘Libra’ to the emergence of different IEO projects- crypto adoption is setting new levels in the world. The word cryptocurrency doesn’t seem too odd now.

The year 2019 has given a whole new meaning to the cryptocurrency sphere. From Facebook announcing its own cryptocurrency project ‘Libra’ to the emergence of different IEO projects- crypto adoption is setting new levels in the world. The word cryptocurrency doesn’t seem too odd now.

59. Cybersecurity in Crypto Trading: Everything You Need to Know

Cybersecurity is one of the world’s most pressing concerns at the moment. State departments, major corporations, healthcare providers, universities, and manufacturing facilities have all been hit hard by cybercrime actors.

Cybersecurity is one of the world’s most pressing concerns at the moment. State departments, major corporations, healthcare providers, universities, and manufacturing facilities have all been hit hard by cybercrime actors.

60. Don't Believe the Hype, Trust History

Look at the fundamentals by using what happened to stock trading when retail investors were allowed to participate as a case study compared to tokenization.

Look at the fundamentals by using what happened to stock trading when retail investors were allowed to participate as a case study compared to tokenization.

61. Trading Instruments - Metatrader 4 Key Functions

The forex market is one of the biggest entities of its type anywhere in the world, with an estimated $6.6 trillion traded globally every single day.

The forex market is one of the biggest entities of its type anywhere in the world, with an estimated $6.6 trillion traded globally every single day.

62. Why Arbitrage is a Sustainable Trading Strategy in the Forex Market

When it comes to Forex trading, most people think that it revolves around the attempt to profit through anticipation of the future direction of a market. But have you ever wondered if there is a way to profit from the forex market without predicting the future direction of a currency pair? You might be interested in finding out that there are numerous market strategies available, and perhaps the least risky out of all is forex arbitrage.

When it comes to Forex trading, most people think that it revolves around the attempt to profit through anticipation of the future direction of a market. But have you ever wondered if there is a way to profit from the forex market without predicting the future direction of a currency pair? You might be interested in finding out that there are numerous market strategies available, and perhaps the least risky out of all is forex arbitrage.

63. What Is Stabila Coin and How Does Stabila Work?

STB is the native cryptocurrency issued by the Stabila POS blockchain. Many fintech applications are being developed on its open source code.

STB is the native cryptocurrency issued by the Stabila POS blockchain. Many fintech applications are being developed on its open source code.

64. Trading Bots

What are Trading Bots in general? Are trading bots useful?

What are Trading Bots in general? Are trading bots useful?

65. DEX Portal to Bring Multichain Exchange Without the Need for Wrapped Tokens

DEX Portal is bringing multichain cross-exchange to the DeFi ecosystem.

DEX Portal is bringing multichain cross-exchange to the DeFi ecosystem.

66. Calculate Required Rate of Return With the Fama-French Three-Factor Model

Investors are always evaluating the amount of risk they are willing to take for a certain expected return. Intuitively, the best investment maximizes the return

Investors are always evaluating the amount of risk they are willing to take for a certain expected return. Intuitively, the best investment maximizes the return

67. How To Grow a Crypto Trading Fund [Interview with a CEO]

In the ever competitive and volatile cryptocurrency market, finding alpha can be a consistent challenge for funds and traders. Retail focused trading platforms now offer risky leveraged trades up to 125x leverage. While a very small percentage might beat the market, most will fail.

In the ever competitive and volatile cryptocurrency market, finding alpha can be a consistent challenge for funds and traders. Retail focused trading platforms now offer risky leveraged trades up to 125x leverage. While a very small percentage might beat the market, most will fail.

68. 6 Trading Strategies to Profit From The Turbulence in Crypto-Markets

Are you currently staying far away from the volatility and plummeting prices of the current crypto-market? It’s a natural reaction, especially in such unpredictable times. The media draws the public attention towards the negatives, but experienced investors see a downturn in any market for what it really is: a great opportunity.

Are you currently staying far away from the volatility and plummeting prices of the current crypto-market? It’s a natural reaction, especially in such unpredictable times. The media draws the public attention towards the negatives, but experienced investors see a downturn in any market for what it really is: a great opportunity.

69. 2020 Noonie Nominee Alyze Sam has Cheated Death Three times

You know that feeling when you work really hard on something for really long and it feels like nobody really notices? Hacker Noon’s Annual Tech Industry Awards, the 2020 Noonies, are here to help with that.

You know that feeling when you work really hard on something for really long and it feels like nobody really notices? Hacker Noon’s Annual Tech Industry Awards, the 2020 Noonies, are here to help with that.

70. The Bitcoin Price in the Long Run (Part 2 - Fibonacci Ratios Everywhere!)

Part 1 of this series of analysis articles introduced Elliott Wave Principle (EWP). The core assumption is counter-intuitive, at first:

Part 1 of this series of analysis articles introduced Elliott Wave Principle (EWP). The core assumption is counter-intuitive, at first:

"The Wave Principle argues that markets are not driven by fundamentals or news, but instead by “social mood” – the collective psychology of all market participants"

71. FTX Implosion TL;DR and Why Proof of Reserves is NOT the Solution We Need

You're reading this because the FTX implosion cascade sent every crypto-influencer into an engagement farming overdrive - "Get Your Crypto off Exchanges

You're reading this because the FTX implosion cascade sent every crypto-influencer into an engagement farming overdrive - "Get Your Crypto off Exchanges

72. What NOT TO DO As A Cryptocurrency Trading N00B

With the advent of global equity and digital currency markets, trading has become more accessible to ordinary individuals than ever before. While there is no denying that effective trading can be immensely rewarding and profitable, most asset classes are known to be unforgiving to even the tiniest of mistakes. The good news, however, is that most of these mistakes can be easily avoided with some prior knowledge and determination.

With the advent of global equity and digital currency markets, trading has become more accessible to ordinary individuals than ever before. While there is no denying that effective trading can be immensely rewarding and profitable, most asset classes are known to be unforgiving to even the tiniest of mistakes. The good news, however, is that most of these mistakes can be easily avoided with some prior knowledge and determination.

73. The Future of AI Automated Investing Solutions For The Common Man

Automated investing solutions, specifically AI based, helps make investing accessible for everyone. It lessens the overwhelm, decreases the costs, and makes in

Automated investing solutions, specifically AI based, helps make investing accessible for everyone. It lessens the overwhelm, decreases the costs, and makes in

74. The Liquidity Crisis - Part One: BTC

Bitcoin supply is becoming scarce in the face of demand - Here's what you need to know.

Bitcoin supply is becoming scarce in the face of demand - Here's what you need to know.

75. On Building a Crypto Trading Platform with Jennifer, Co-founder of Coinstore

In with the new, out with the old. Coinstore is the crypto exchange for the new generation. Learn what their co-founder, Jennifer, has to say.

In with the new, out with the old. Coinstore is the crypto exchange for the new generation. Learn what their co-founder, Jennifer, has to say.

76. How the Breakeven Level of Mining Allows to Determine the Pivot Point of BTC

77. How many borders are closed for trades due to fear and insecurity?

The current world is a very interconnected place. Countries trade with other countries, selling them the surplus of goods they produce and buying goods they don’t have in sufficient quantities. International trade encourages countries to specialize in producing only those goods and services which they can produce with the most efficiency at the lowest cost. It also makes it harder for domestic monopolies to thrive, because they face competition from foreign companies. Almost all economists agree that international trading is beneficial for all participants. But still, some countries are restricted from trading for various reasons. In this article we’ll try to understand the restrictions that many countries face, and how they can overcome them, using blockchain solutions.

The current world is a very interconnected place. Countries trade with other countries, selling them the surplus of goods they produce and buying goods they don’t have in sufficient quantities. International trade encourages countries to specialize in producing only those goods and services which they can produce with the most efficiency at the lowest cost. It also makes it harder for domestic monopolies to thrive, because they face competition from foreign companies. Almost all economists agree that international trading is beneficial for all participants. But still, some countries are restricted from trading for various reasons. In this article we’ll try to understand the restrictions that many countries face, and how they can overcome them, using blockchain solutions.

78. Bitcoin Navigator - Price Analysis [November, 2019]

Hello friends and HODLers

Hello friends and HODLers

79. How I Made a 65% ROI with this Boeing Trading Algorithm

Since the market crashed in March of 2020 the rebound has been swift and irrational.

Since the market crashed in March of 2020 the rebound has been swift and irrational.

80. Move Over Perpetual Contracts - Leveraged ETFs Are The Hot Favorite Of Crypto Speculators

The concept of trading cryptocurrencies goes well beyond just buying and selling Bitcoin. Since the inception of futures, perpetuals, derivatives, and leveraged ETFs, the playing field has expanded significantly.

The concept of trading cryptocurrencies goes well beyond just buying and selling Bitcoin. Since the inception of futures, perpetuals, derivatives, and leveraged ETFs, the playing field has expanded significantly.

81. What I've Learned from Years of Arbitrage and Market Making

Introduction

Introduction

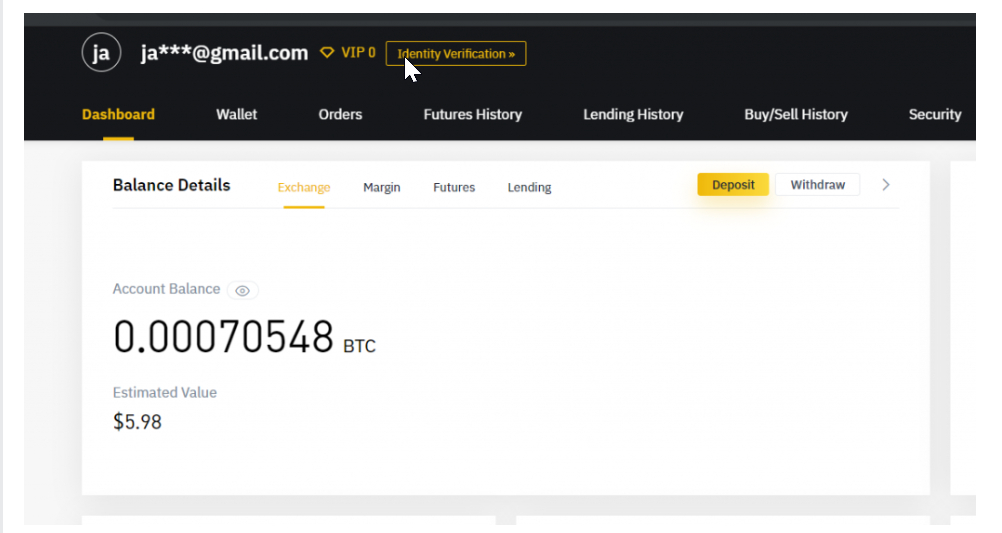

82. POC Bot Selling Feature #9: Auto-Withdraw Realized PNL Take Profit

Lol with me if you can find the spelling mistake embedded in my code? :D

Lol with me if you can find the spelling mistake embedded in my code? :D

83. Not Your Keys, Not Your Coins, or Consequences of Using API Keys for Trading

Using trading bots is a common practice among crypto traders but what does the case with 3Commas teaches us? How to protect funds when using a trading bot.

Using trading bots is a common practice among crypto traders but what does the case with 3Commas teaches us? How to protect funds when using a trading bot.

84. Scalping Is the Best Strategy for Trading Crypto During Price Corrections

During the day, a trader opens and closes positions many times - with a frequency of 1 to 15 minutes.

During the day, a trader opens and closes positions many times - with a frequency of 1 to 15 minutes.

85. KuCoin Partners with Chingari to Distribute $20 Million Rupees Worth of Tokens

KuCoin, one of the major cryptocurrency exchanges, has partnered with Chingari, a short video-sharing app to distribute tokens worth $20 million rupees.

KuCoin, one of the major cryptocurrency exchanges, has partnered with Chingari, a short video-sharing app to distribute tokens worth $20 million rupees.

86. Should One Invest in the Financial Markets During Economic Downturns?

An economic downturn does not mean investors should veer away from investing and trading in the financial markets. It is still possible to scoop profits during a recession.

An economic downturn does not mean investors should veer away from investing and trading in the financial markets. It is still possible to scoop profits during a recession.

87. Fraud Detection to Robo Investing: AI in Finance is Rising

Artificial intelligence (AI) is transforming the world of finance by allowing financial institutions to make more accurate and data-driven decisions.

Artificial intelligence (AI) is transforming the world of finance by allowing financial institutions to make more accurate and data-driven decisions.

88. The Scalability Problem of Blockchains [ELI5]

Since the invention of Bitcoin, scalability has always been a problem with the underlying blockchain that powers it.

Since the invention of Bitcoin, scalability has always been a problem with the underlying blockchain that powers it.

89. Zenon Network Aims To Be Satoshi's Ethereum: STEX Bullish on Aliens

My suggestion for most people is to buy ZNN or QSR from STEX, then immediately withdraw as native ZNN or QSR to their SYRIUS wallet.

My suggestion for most people is to buy ZNN or QSR from STEX, then immediately withdraw as native ZNN or QSR to their SYRIUS wallet.

90. Build on Your Trading Knowledge: What Are Stop Loss and Stop Limit Orders?

I bet you’re guessing a stop-loss order, and you’re right. In fact, it’s one of the most common risk management techniques to limit potential losses.

I bet you’re guessing a stop-loss order, and you’re right. In fact, it’s one of the most common risk management techniques to limit potential losses.

91. Bitcoin ATH Notwithstanding, Gold Price Is Rallying Towards Its Own Highs

The thing that most likely raised quite a few eyebrows this week was – in addition to gold’s recent move by itself – the fact that gold rallied mostly without the dollar’s help. Yesterday (Jan. 5) I wrote that one swallow doesn’t make a summer and that a single session rarely changes much.

The thing that most likely raised quite a few eyebrows this week was – in addition to gold’s recent move by itself – the fact that gold rallied mostly without the dollar’s help. Yesterday (Jan. 5) I wrote that one swallow doesn’t make a summer and that a single session rarely changes much.

92. "Volatility is Totally Necessary" - Interview with Robin Janaway and David Fabiyi

The crypto industry is known far and wide for its volatility, which many officials see as a major problem. On the other hand, experienced traders do not view it as such

The crypto industry is known far and wide for its volatility, which many officials see as a major problem. On the other hand, experienced traders do not view it as such

93. The Growth of PFOF and How it Really Works

PFOF has become most affordable trading approach yielding great profits for everyone, especially after SEC disclosure of information amendment

PFOF has become most affordable trading approach yielding great profits for everyone, especially after SEC disclosure of information amendment

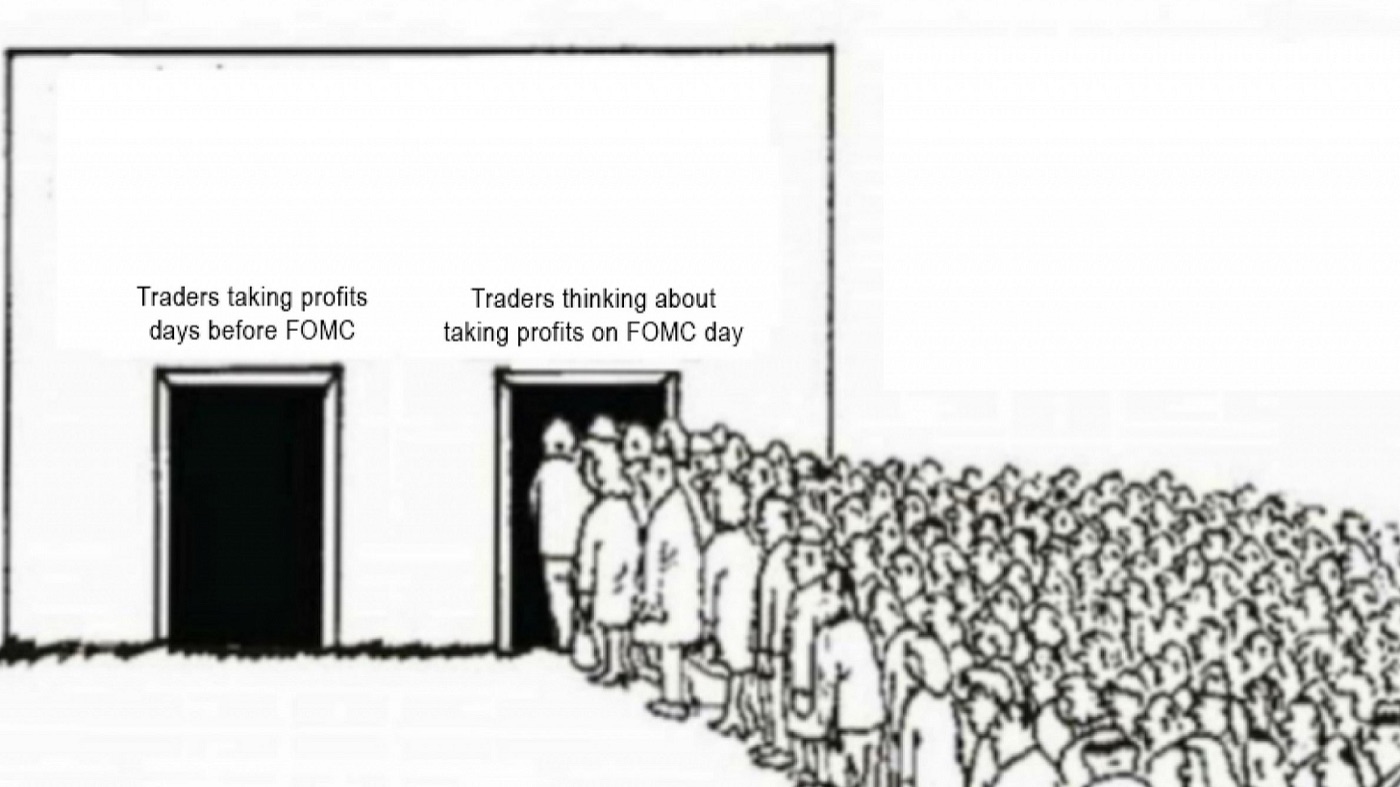

94. Bitcoin Whitepaper 14th Anniversary and Upcoming FOMC 💊

Crypto markets saw some oomph over the weekend but have now begun to take another breather.

Crypto markets saw some oomph over the weekend but have now begun to take another breather.

95. What is a Copy Trading Platform and Why We Need One for Cryptocurrencies?

Copy trading is often confused with social trading, but they differ largely from each other.

Copy trading is often confused with social trading, but they differ largely from each other.

96. Exotic Markets Bringing Derivatives & Structured Products to Solana Ecosystem

Exotic Markets is bringing crypto-based derivatives and structured products to the Solana blockchain.

Exotic Markets is bringing crypto-based derivatives and structured products to the Solana blockchain.

97. Proof of Stake (PoS): Staking as a Tool For The Passive Income

Proof of Stake (PoS): Pros and Cons of Staking as a Tool For The Passive Income

Proof of Stake (PoS): Pros and Cons of Staking as a Tool For The Passive Income

98. 6 Important Factors That Influence the Strike Price of Stock Options

In this article, we will study the concept and then outline some factors to consider when calculating the strike price.

In this article, we will study the concept and then outline some factors to consider when calculating the strike price.

99. Bitcoin Bear Market: Is It Over Now?

We take a look at Bitcoin from the technical perspective

We take a look at Bitcoin from the technical perspective

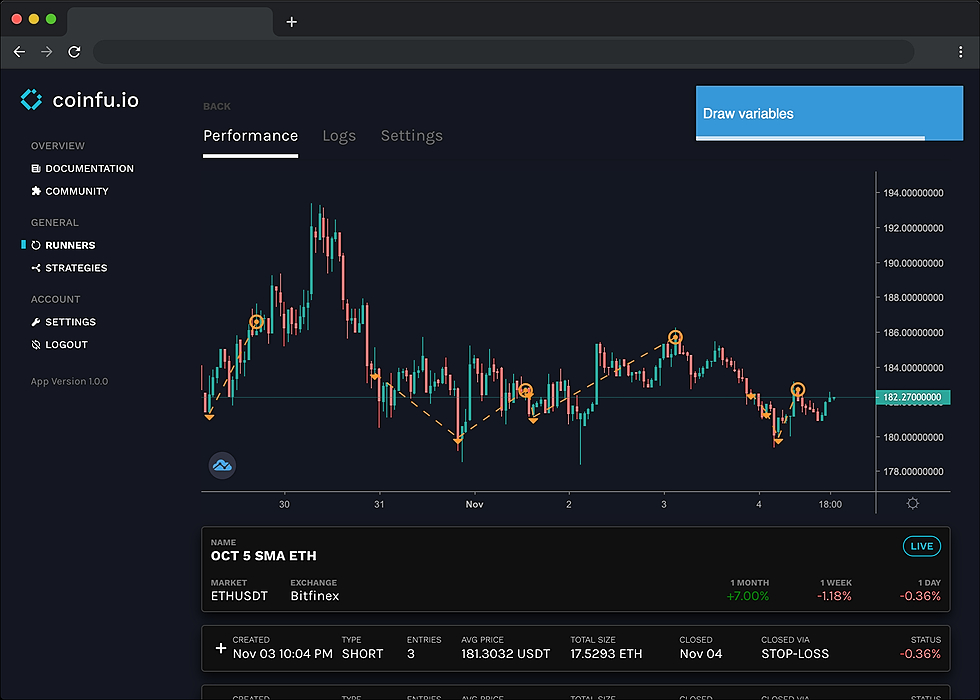

100. Why I Built a No Code Platform to Automate my Cryptocurrency Trading

During the past couple of years, I’ve been building and running my own automated cryptocurrency trading strategies. While I am not as profitable as my naive past-self imagined, I did discover a few things that helped me grow, and ultimately change how I perceive and approach the markets.

During the past couple of years, I’ve been building and running my own automated cryptocurrency trading strategies. While I am not as profitable as my naive past-self imagined, I did discover a few things that helped me grow, and ultimately change how I perceive and approach the markets.

101. Best Trading Apps for Europeans: 2020 Report

The most exciting part of trading is the thrill of mitigating your risks in favor of your rewards. For those who are just starting, it’s a game of knowing when to buy and knowing when to sell. Or, as most traders would say, "Buy low, sell high"! But, how do you know if the prices of stocks and securities are low or high?

The most exciting part of trading is the thrill of mitigating your risks in favor of your rewards. For those who are just starting, it’s a game of knowing when to buy and knowing when to sell. Or, as most traders would say, "Buy low, sell high"! But, how do you know if the prices of stocks and securities are low or high?

102. A Hard Look Into Noticeable Cross-Exchange Inefficiencies [freebie inside]

Price action tends to happen where people are planning to keep the crypto they buy. A bigger movement on a spot exchange easily translates into a much more radical move on the exchanges that match and mirror cash’s behavior, like perpetual swaps and futures.

Price action tends to happen where people are planning to keep the crypto they buy. A bigger movement on a spot exchange easily translates into a much more radical move on the exchanges that match and mirror cash’s behavior, like perpetual swaps and futures.

103. Risk-Free Futures Market Making by Hedging Long Straddle Options

104. The Markets Are Out of Order. How To #BreakTheCycle

Last week’s markets were a whirlwind making history for not one, but two crashes now called Black Monday (2020) and Black Thursday (2020). On each of these days, market-wide curbs, also called trading circuit breakers, kicked in to prevent panic selling and rapid market decline when the markets dropped more than 7% after the opening bell.

Last week’s markets were a whirlwind making history for not one, but two crashes now called Black Monday (2020) and Black Thursday (2020). On each of these days, market-wide curbs, also called trading circuit breakers, kicked in to prevent panic selling and rapid market decline when the markets dropped more than 7% after the opening bell.

105. Formulas of Uniswap: A Deep Dive

Find out the benefits of concentrated liquidity for multiple pooled assets in Uniswap.

Find out the benefits of concentrated liquidity for multiple pooled assets in Uniswap.

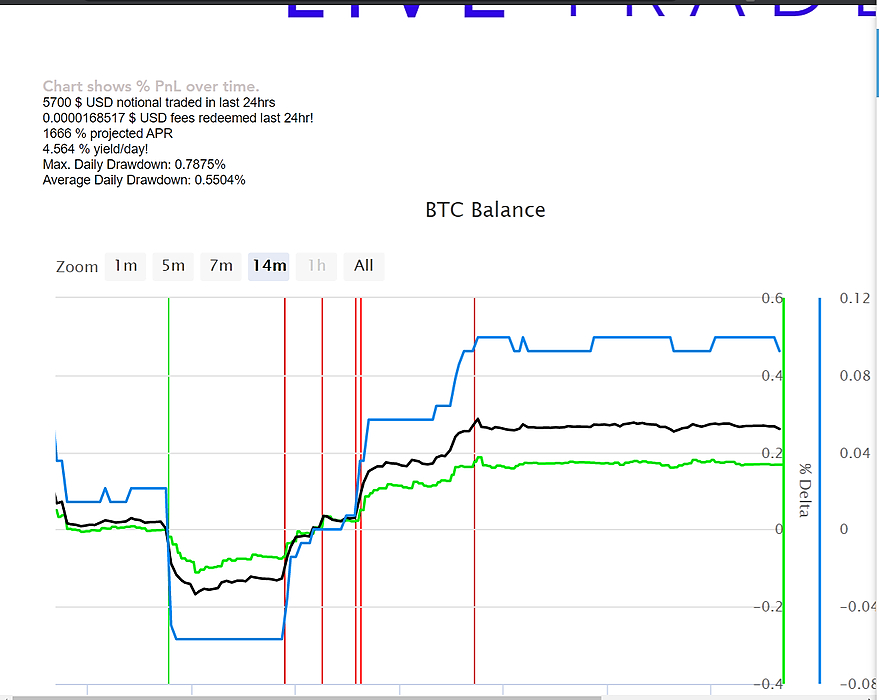

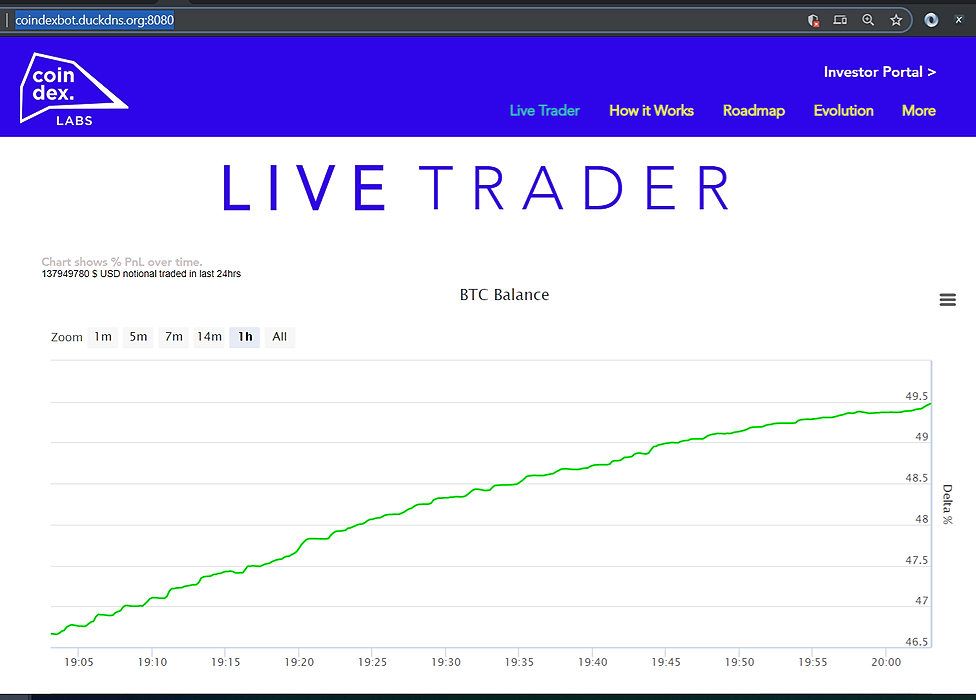

106. I Built a Crypto-Trading Bot...and Am Now Looking For People to Share My Profits With

107. “Bitcoin Is Up! Oh, Nevermind”: What Volatility Means for Crypto Investors

“Bitcoin Is Up! Oh, Nevermind”: What Volatility Means for Crypto Investors

“Bitcoin Is Up! Oh, Nevermind”: What Volatility Means for Crypto Investors

108. Candlestick Analysis & Top Patterns

As we have already figured out, in all financial markets the price of any asset is shown in the form of graphs that are constantly changing during the trading session. Candlestick analysis of the currency market remains popular to this day, proving its effectiveness and relevance.

As we have already figured out, in all financial markets the price of any asset is shown in the form of graphs that are constantly changing during the trading session. Candlestick analysis of the currency market remains popular to this day, proving its effectiveness and relevance.

109. The Eightfold Path of the Legendary Trader

Like many traders, I read Market Wizards as a kid. If you don’t know it, it’s a collection of interviews with the most legendary traders of the 1980s.

Like many traders, I read Market Wizards as a kid. If you don’t know it, it’s a collection of interviews with the most legendary traders of the 1980s.

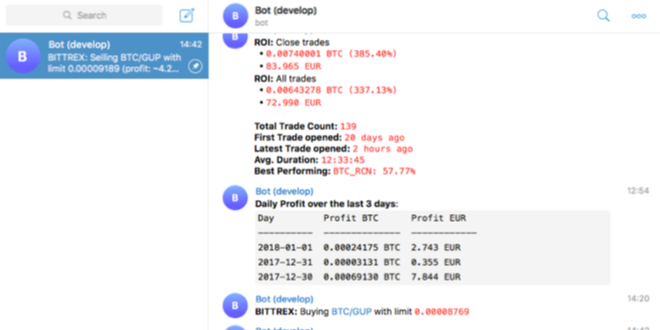

110. How to Build Telegram Chats with a Crypto-trading Bot

Perhaps a sign of the times: my most active Telegram chat is with a crypto-trading bot that constantly listens for opportunities to trade on my behalf. I used an open-source library to develop some strategies and configure the bot to execute them using my Binance account. The bot communicates all of its trades through Telegram and can reply to my requests to take action or share live updates.

Perhaps a sign of the times: my most active Telegram chat is with a crypto-trading bot that constantly listens for opportunities to trade on my behalf. I used an open-source library to develop some strategies and configure the bot to execute them using my Binance account. The bot communicates all of its trades through Telegram and can reply to my requests to take action or share live updates.

111. A crypto-trader’s diary — week 1

I have decided that I want to become a person who trades bitcoin for a living.

I have decided that I want to become a person who trades bitcoin for a living.

112. POC Bot #1 Up 31.5% in 5 Hours – 3% Max Drawdown

View This Post in It’s Original Form on dunncreativess.github.io!

View This Post in It’s Original Form on dunncreativess.github.io!

113. Why Deep Reinforcement Learning is the Future of Automated Trading?

Image Courtesy:- Pexels.com

Image Courtesy:- Pexels.com

114. Lux Algo: Separating Information From The Static During The 2022 Crypto Winter

The 2022 crypto winter is entering its fourth month, with many investors panicking before the end of the year.

The 2022 crypto winter is entering its fourth month, with many investors panicking before the end of the year.

115. Comparing the Best Charts to Launch Your Fintech App

The overview and comparison of 4 best downloadable self-hosted charting libraries: TW, DXcharts, ChartIQ, HC. You decide which to use for your financial startup

The overview and comparison of 4 best downloadable self-hosted charting libraries: TW, DXcharts, ChartIQ, HC. You decide which to use for your financial startup

116. How Technology is Useful to Swing Traders

Technology has a huge impact on our everyday lives, especially for traders. From the moment you wake up (to check how the market behaved overnight), to the moment you go back to sleep (to check how markets will open on the other side of the world), technology plays a huge role in ensuring that every trader has the necessary tools and resources to create a successful career.Advanced technology has been the key factor in transforming the way things are done, especially for financial markets. It is the core of how traders operate and maintain their competitive edge in a cutthroat financial market environment.In this digital age, trading continues to evolve due to innovative technology. Here are a few things that have become very useful for traders due to technological innovation.

Technology has a huge impact on our everyday lives, especially for traders. From the moment you wake up (to check how the market behaved overnight), to the moment you go back to sleep (to check how markets will open on the other side of the world), technology plays a huge role in ensuring that every trader has the necessary tools and resources to create a successful career.Advanced technology has been the key factor in transforming the way things are done, especially for financial markets. It is the core of how traders operate and maintain their competitive edge in a cutthroat financial market environment.In this digital age, trading continues to evolve due to innovative technology. Here are a few things that have become very useful for traders due to technological innovation.

117. Large Companies May Take Metaverse Market Share from Small Startups

The large game companies with all the capital, user base and creativity are probably in the best position to take the metaverse to the next level.

The large game companies with all the capital, user base and creativity are probably in the best position to take the metaverse to the next level.

118. Indebted to the Tech

Having been in software long enough to work across industries and with a variety of distributed systems, I know every system has its day. Software and systems engineers create performance requirements, latency constraints, and sweat the details on software quality. Their hard work ensures retail sites stay online through black Friday, ad campaigns survive the Superbowl, accounting systems make it through tax season, and media sites stay up to date during the election. And that’s not even counting safety critical systems we rely on each day, systems that keep our hospitals, our vehicles, and our industries humming.

Having been in software long enough to work across industries and with a variety of distributed systems, I know every system has its day. Software and systems engineers create performance requirements, latency constraints, and sweat the details on software quality. Their hard work ensures retail sites stay online through black Friday, ad campaigns survive the Superbowl, accounting systems make it through tax season, and media sites stay up to date during the election. And that’s not even counting safety critical systems we rely on each day, systems that keep our hospitals, our vehicles, and our industries humming.

119. FTX, Alameda & SBF: A Breakdown of Events

A true representation of what went down with FTX, Alameda & SBF. This article also highlights the necessity of decentralization in the financial markets.

A true representation of what went down with FTX, Alameda & SBF. This article also highlights the necessity of decentralization in the financial markets.

120. How News Affects Crypto Prices

In this article we’ll discuss how news trading strategy works and how to use it to your advantage in Crypto World.

In this article we’ll discuss how news trading strategy works and how to use it to your advantage in Crypto World.

121. 7 Ways to Become a Better Trader

Getting into the trading world has always been a challenging adventure

Getting into the trading world has always been a challenging adventure

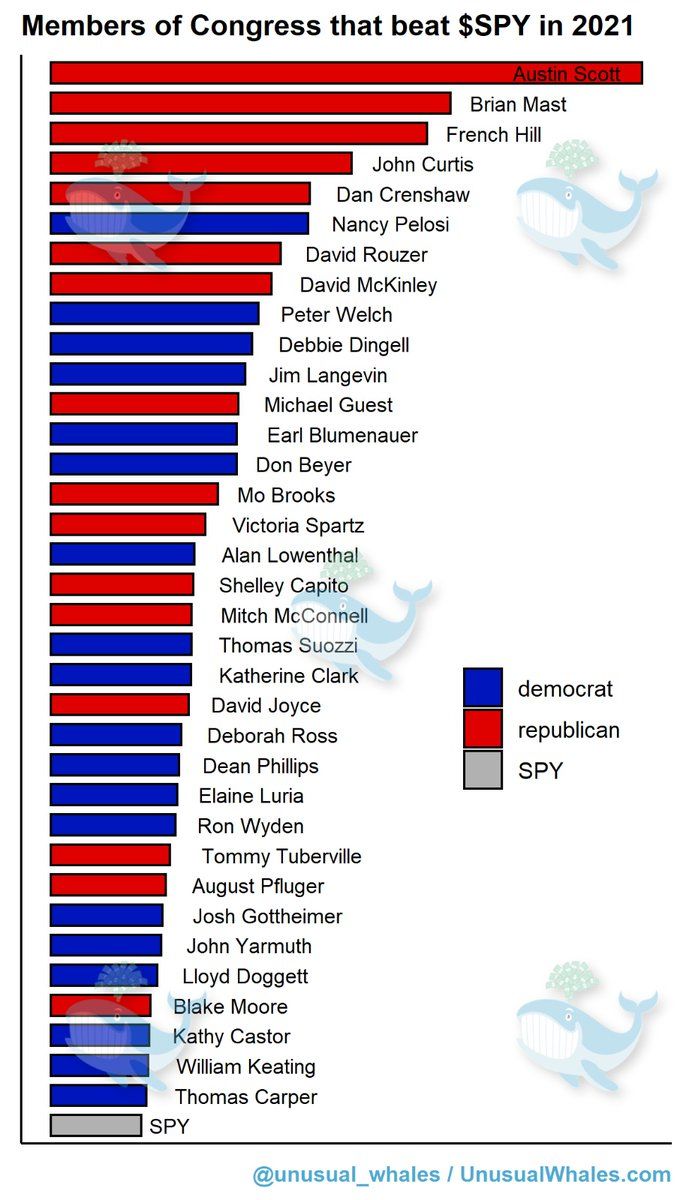

122. Members of Congress Beat the Snot Out of Markets in 2021

In short, many members of Congress beat the market in 2021. They traded more than ever before.

In short, many members of Congress beat the market in 2021. They traded more than ever before.

And they made numerous unusually timed trades and huge gains.

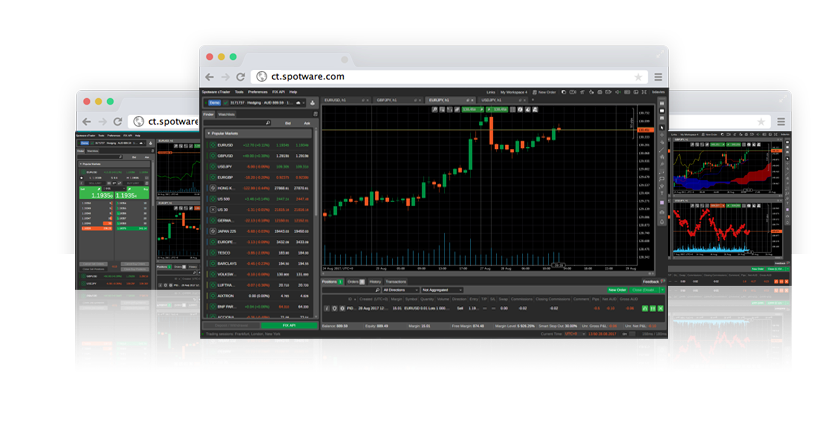

123. cTrader’s Ascent and the Slow Death of MT4

If you ask your average retail Forex trader what platform they use, they are probably going to say MetaTrader 4 (MT4). The venerable grandaddy of the Forex trading platforms, MT4 has been around since 2005 and is still much more popular than any other trading platform.

If you ask your average retail Forex trader what platform they use, they are probably going to say MetaTrader 4 (MT4). The venerable grandaddy of the Forex trading platforms, MT4 has been around since 2005 and is still much more popular than any other trading platform.

124. How to Make Money on "Relief" During the Bear Market

How to make money on "relief" during the Bear Market

How to make money on "relief" during the Bear Market

125. Can We Predict the Future of Cryptocurrency?

What's the future of cryptocurrency? With all eyes focused on the global economic climate and a tumultuous recent history for crypto, it's anything but clear.

What's the future of cryptocurrency? With all eyes focused on the global economic climate and a tumultuous recent history for crypto, it's anything but clear.

126. Average True Range (ATR): What it is and Its Role in Trading

Everyone wants to know when their favorite cryptocurrency will burst into volatility? And let’s be real, I’m guessing you’re no exception.

Everyone wants to know when their favorite cryptocurrency will burst into volatility? And let’s be real, I’m guessing you’re no exception.

127. What is Online Trading?

Online trading comes with a number of risks, so it's important to understand what you're getting into before placing any trades.

Online trading comes with a number of risks, so it's important to understand what you're getting into before placing any trades.

128. Timechain one of the First Licensed DEX Aggregator brings Compliance to Fantom, BSC and Ethereum

Timechain, a decentralized exchange aggregator and permissionless lending and borrowing protocol introduced regulated AMM, Liquidity pools, farming.

Timechain, a decentralized exchange aggregator and permissionless lending and borrowing protocol introduced regulated AMM, Liquidity pools, farming.

129. Forget About Bitcoin's Price Predictions. Do This Instead

Bitcoin price predictions are great but usually wrong. Dismiss them at your own peril, but also to go beyond them.

Bitcoin price predictions are great but usually wrong. Dismiss them at your own peril, but also to go beyond them.

130. What is A Credit Spread And Why Is It Important?

There are many instruments on the financial market investment houses use to predict the future, describe the present and, of course, make money.

There are many instruments on the financial market investment houses use to predict the future, describe the present and, of course, make money.

131. All Cryptocurrency Exchanges Fail for the Same Reason

There’s a major contradiction in the cryptocurrency world right now. The invention of Bitcoin was supposed to bring about the new age of finance; one with trustless transactions, frictionless cross-border transactions, and censorship-proof Internet cash.

There’s a major contradiction in the cryptocurrency world right now. The invention of Bitcoin was supposed to bring about the new age of finance; one with trustless transactions, frictionless cross-border transactions, and censorship-proof Internet cash.

132. Can You Consistently Beat the FX Markets using AI Trading Software, Without Actually Trading?

133. Fake Volumes & Wash Trades on Exchanges: What should we Believe?

Nearly 70% of all cryptocurrency volume displayed on CoinMarketCap is fake. At least, that’s according to the research done by Alameda Research. This is a huge problem for anyone trying to determine what cryptocurrencies are popular and define a strategy based on the market data. While the methodology of estimation may vary, the common principle is the same: researchers exclude the shady exchanges that tend to misreport the volume and leave only the more or less reliable ones, such as Binance or Bittrex.

Nearly 70% of all cryptocurrency volume displayed on CoinMarketCap is fake. At least, that’s according to the research done by Alameda Research. This is a huge problem for anyone trying to determine what cryptocurrencies are popular and define a strategy based on the market data. While the methodology of estimation may vary, the common principle is the same: researchers exclude the shady exchanges that tend to misreport the volume and leave only the more or less reliable ones, such as Binance or Bittrex.

134. Perpetual Swaps - Origins in CEX, with a Future in DeFi!

Perpetual Swaps, the single biggest primitive still missing from the Bitcoin DeFi puzzle, are coming to Bitcoin-based DeFi thanks to Sovryn.

Perpetual Swaps, the single biggest primitive still missing from the Bitcoin DeFi puzzle, are coming to Bitcoin-based DeFi thanks to Sovryn.

135. Understanding Exponential Moving Average (EMA) for Trading

Broadly technical analysis is all about seeing the trend and predicting the future. Future is always uncertain and there is probability involved. I recommend using many indicators for a hawk eye view as it will provide the required congruence and high chance of success.

Broadly technical analysis is all about seeing the trend and predicting the future. Future is always uncertain and there is probability involved. I recommend using many indicators for a hawk eye view as it will provide the required congruence and high chance of success.

136. What Are The Risks Associated with HODLing Crypto?

Cryptocurrencies are digital or virtual currencies created on something called the blockchain, a public ledger that stores the information about cryptocurrency

Cryptocurrencies are digital or virtual currencies created on something called the blockchain, a public ledger that stores the information about cryptocurrency

137. Top 3 Biggest Problems With Cryptocurrency Trading

Trading the cryptocurrency market can be an extremely lucrative endeavor if done properly. We all heard those stories of people making huge profits in a very short amount of time or with a little amount of money as the token they’ve invested some spare change skyrocketed over a period of a couple of weeks to extreme highs and made staggering returns. The promise of quick and enormous gains especially attracts the novice and those who would never even consider trading or investing which is why we have seen the creation of a great speculative bubble in 2017 when the mania was at its peak looking like everyone was an expert crypto trader. And it was as everyone is a genius in a bull market.

Trading the cryptocurrency market can be an extremely lucrative endeavor if done properly. We all heard those stories of people making huge profits in a very short amount of time or with a little amount of money as the token they’ve invested some spare change skyrocketed over a period of a couple of weeks to extreme highs and made staggering returns. The promise of quick and enormous gains especially attracts the novice and those who would never even consider trading or investing which is why we have seen the creation of a great speculative bubble in 2017 when the mania was at its peak looking like everyone was an expert crypto trader. And it was as everyone is a genius in a bull market.

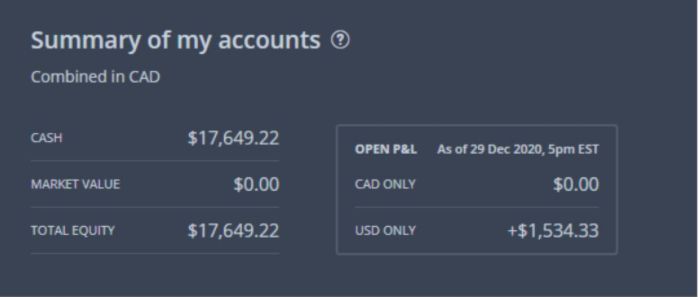

138. Market Maker at 10%: Realized Live Gains, Signal-Based Bots at 1%, 7%!

See this post on it's original location, github.io!

See this post on it's original location, github.io!

It’s been a busy few days for me!

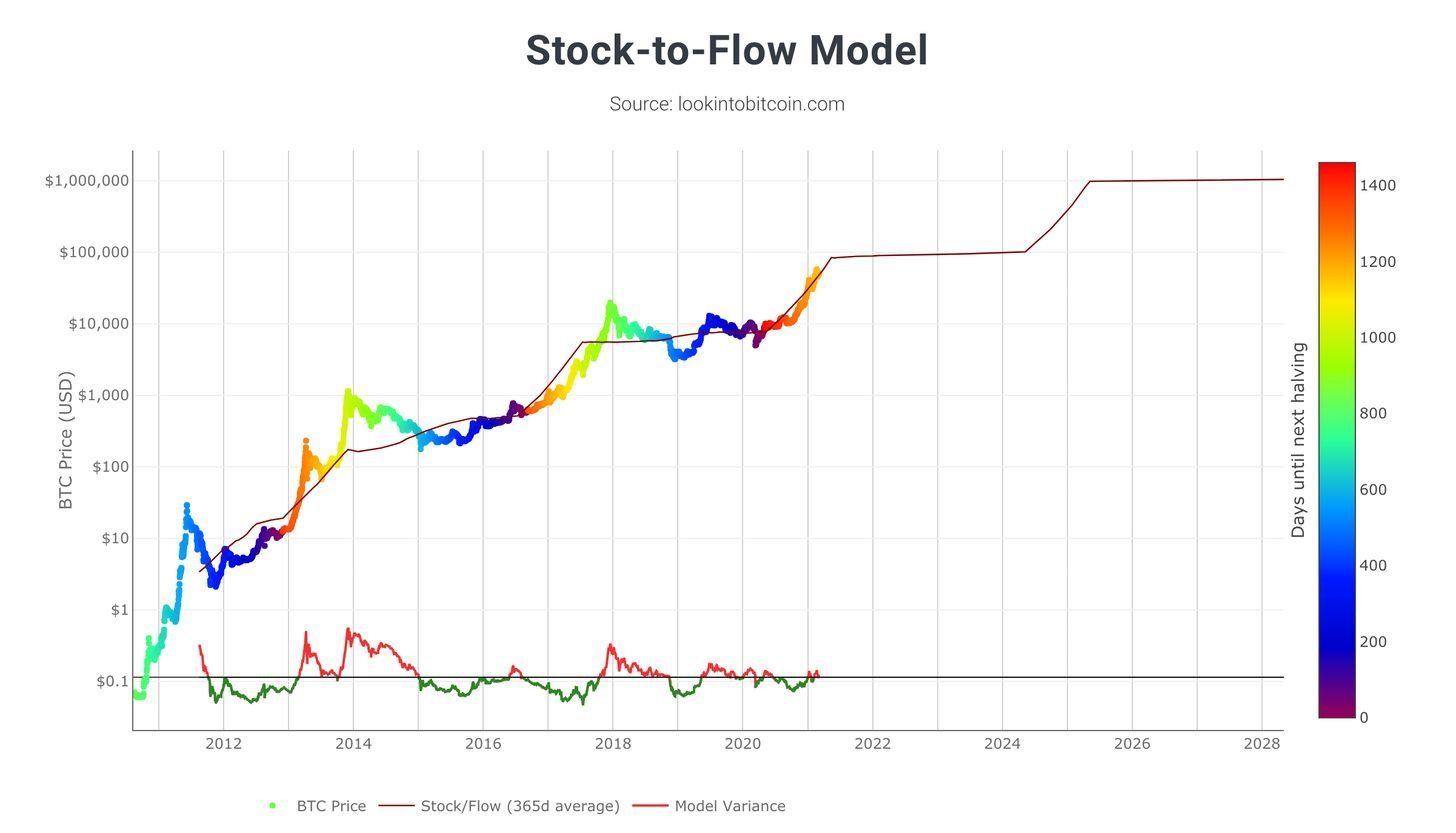

139. Bitcoin – Comparing Previous Market Cycles With The Bull Run of 2021

Bitcoin is booming. Just recently Elon Musk announced via a SEC filing that he put 10% of Tesla’s balance sheet into Bitcoin. However, every time there is a big drop people are scared that the end is near and that Bitcoin goes again down 80-90% like it did in 2018.. or 2014… or 2013. You see where I am getting there – Bitcoin often does that. Hence, we have market cycles and this article will look over previous market cycles in Bitcoin and where Bitcoin stands today.

Bitcoin is booming. Just recently Elon Musk announced via a SEC filing that he put 10% of Tesla’s balance sheet into Bitcoin. However, every time there is a big drop people are scared that the end is near and that Bitcoin goes again down 80-90% like it did in 2018.. or 2014… or 2013. You see where I am getting there – Bitcoin often does that. Hence, we have market cycles and this article will look over previous market cycles in Bitcoin and where Bitcoin stands today.

140. HODLing: Risks and Rewards Every Crypto HODLer Should Know

HODL cryptocurrency is the best strategy when trading crypto. But you can earn long-term interest with your existing assets to earn even more.

HODL cryptocurrency is the best strategy when trading crypto. But you can earn long-term interest with your existing assets to earn even more.

141. Decreasing Latency for High Frequency Crypto Arbitrage Trading

Decreasing latency between cloud regions for HFT crypto trading

Decreasing latency between cloud regions for HFT crypto trading

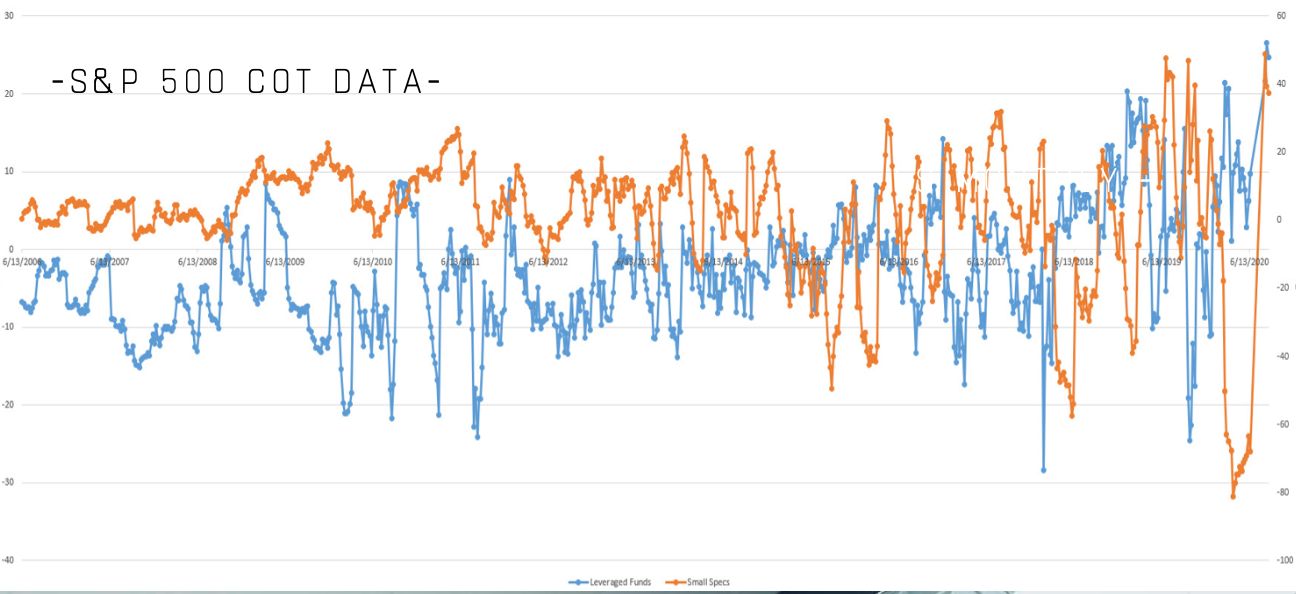

142. Analyzing The Commitment of Traders [COT] Report

The Commitment of Traders Report is one of the prime sources of data for many futures and forex traders. You may have even seen the graphs referenced in our Weekly Reports. But what exactly does COT data tell you and how can you use it to improve your trading? We tackle these questions in our latest blog below.

The Commitment of Traders Report is one of the prime sources of data for many futures and forex traders. You may have even seen the graphs referenced in our Weekly Reports. But what exactly does COT data tell you and how can you use it to improve your trading? We tackle these questions in our latest blog below.

143. The Curious Case of Exchange Traded Funds or ETFs

First thing first, it is important to mention that ETF is an instrument that allows you to invest in a fund that makes investments in stocks, bonds, or other assets and, in return, to receive an interest in that investment pool. ETF shares are traded on a national stock exchange.

First thing first, it is important to mention that ETF is an instrument that allows you to invest in a fund that makes investments in stocks, bonds, or other assets and, in return, to receive an interest in that investment pool. ETF shares are traded on a national stock exchange.

144. Meme Stocks: What Do they Mean for The Stock Market?

Diving into the story of Reddit-induced surge of GameStop’s stocks, how it impacted the economy, and how should investors treat these types of stocks.

Diving into the story of Reddit-induced surge of GameStop’s stocks, how it impacted the economy, and how should investors treat these types of stocks.

145. Cryptocurrency Trading Bible Four: Secrets of the Bitmex Masters

“Do you Mex?”

“Do you Mex?”

146. THE 10 CRYPTO COMMANDMENTS

Expensive lessons I’ve learned in the past year.

Expensive lessons I’ve learned in the past year.

147. How AI and Crypto Work Together

How AI will affect crypto? And how does that work now?

How AI will affect crypto? And how does that work now?

148. How to Gain Financial Security As a Man with this 5 Safe Tips

‘The risk comes from not knowing what you're doing,' says the rich person.

‘The risk comes from not knowing what you're doing,' says the rich person.

149. Marketing Tips For Open-Source Projects

Tips on how to get started with the marketing of your open-source project.

Tips on how to get started with the marketing of your open-source project.

150. Digital Derivatives, Their Types and Specifics of Their Use

Blockchain has already created new ways of managing businesses. Now, its constant development can lead to the complete disruption of traditional finance. We can observe how it starts when a new spot for digital asset products appears, such as cryptocurrencies and stablecoin. Their development led to the rapid growth of the digital-based derivatives market.

Blockchain has already created new ways of managing businesses. Now, its constant development can lead to the complete disruption of traditional finance. We can observe how it starts when a new spot for digital asset products appears, such as cryptocurrencies and stablecoin. Their development led to the rapid growth of the digital-based derivatives market.

151. Could xDEXs Do To UniSwap What UniSwap Did To DEXs and CEXs?

On September 22, 2020 a new cross-chain decentralized exchange (xDEX) launched called mimo 8 - a fully decentralized protocol with automated liquidity.

On September 22, 2020 a new cross-chain decentralized exchange (xDEX) launched called mimo 8 - a fully decentralized protocol with automated liquidity.

152. Should you use a Sector Rotation Strategy?

‘What goes around comes around’

‘What goes around comes around’

153. An Open Essay on the U.S. Federal Reserve, Treasuries, Cryptocurrencies and More: Part 1

The Federal Reserve is raising rates. Markets are turning bearish. Can crypto, bitcoin, or the market rise higher? Here's how to help navigate the markets today

The Federal Reserve is raising rates. Markets are turning bearish. Can crypto, bitcoin, or the market rise higher? Here's how to help navigate the markets today

154. The Cryptocurrency Trading Bible Two: The Seven Deadly Sins of Technical Analysis

So you read the original Cryptocurrency Trading Bible and you jumped head first into the great game?

So you read the original Cryptocurrency Trading Bible and you jumped head first into the great game?

155. A Brief Look at of Some of the Richest NFT Collectors of all Time

As you may know, Apollo42 tracks top NFT traders based on profit made. Notably, that means the top wallet holders are sure to stand out among the rest. We took the time to examine these top traders so you can learn a little more about stories and people behind those shocking NFT profits.

As you may know, Apollo42 tracks top NFT traders based on profit made. Notably, that means the top wallet holders are sure to stand out among the rest. We took the time to examine these top traders so you can learn a little more about stories and people behind those shocking NFT profits.

156. BITLEVEX Secures $50m From GEM Digital

Estonia-based investment platform BITLEVEX announced that it had secured an investment facility totaling $50M from GEM Digital Limited.

Estonia-based investment platform BITLEVEX announced that it had secured an investment facility totaling $50M from GEM Digital Limited.

157. How to Become a Private Home Trader and 10 Tips to Help You Get There

Trading is a booming sector that today attracts many people. Here are 10 tips to help you succeed as a trader.

Trading is a booming sector that today attracts many people. Here are 10 tips to help you succeed as a trader.

158. Lets Graph Simple Moving Averages Using Rust

Simple Moving Averages are calculated by getting the mean closing price over a period of time. Lets see on how we can program that idea into Rust.

Simple Moving Averages are calculated by getting the mean closing price over a period of time. Lets see on how we can program that idea into Rust.

159. Lower Trading Fees Make Bitcoin Futures More Appealing to Speculators

Trading Bitcoin futures is a great way to gain exposure to cryptocurrency. Over a dozen different platforms offer such services, each with their individual fees. Finding the lowest fees on the market will directly influence one's potential profits.

Trading Bitcoin futures is a great way to gain exposure to cryptocurrency. Over a dozen different platforms offer such services, each with their individual fees. Finding the lowest fees on the market will directly influence one's potential profits.

160. We Built A Trader's Almanac And The Results Are Promising

ANN

ANN

161. Trading Bots vs Humans · Everything you need to know

Over the past 10 years we've seen the rise and rise of trading bots and Quantitative Funds and we've seen the fall and fall of traditional Asset Managers and Hedge Funds.

Over the past 10 years we've seen the rise and rise of trading bots and Quantitative Funds and we've seen the fall and fall of traditional Asset Managers and Hedge Funds.

162. "Trading Binary Options in Crypto Is NOT About Instant Wealth" - Artem Levin

Nowadays, binary options trading has transformed into one of the most popular financial products of the Internet era.

Nowadays, binary options trading has transformed into one of the most popular financial products of the Internet era.

163. Understanding Exponential Moving Average (EMA) for Trading

Broadly technical analysis is all about seeing the trend and predicting the future. Future is always uncertain and there is probability involved. I recommend using many indicators for a hawk eye view as it will provide the required congruence and high chance of success.

Broadly technical analysis is all about seeing the trend and predicting the future. Future is always uncertain and there is probability involved. I recommend using many indicators for a hawk eye view as it will provide the required congruence and high chance of success.

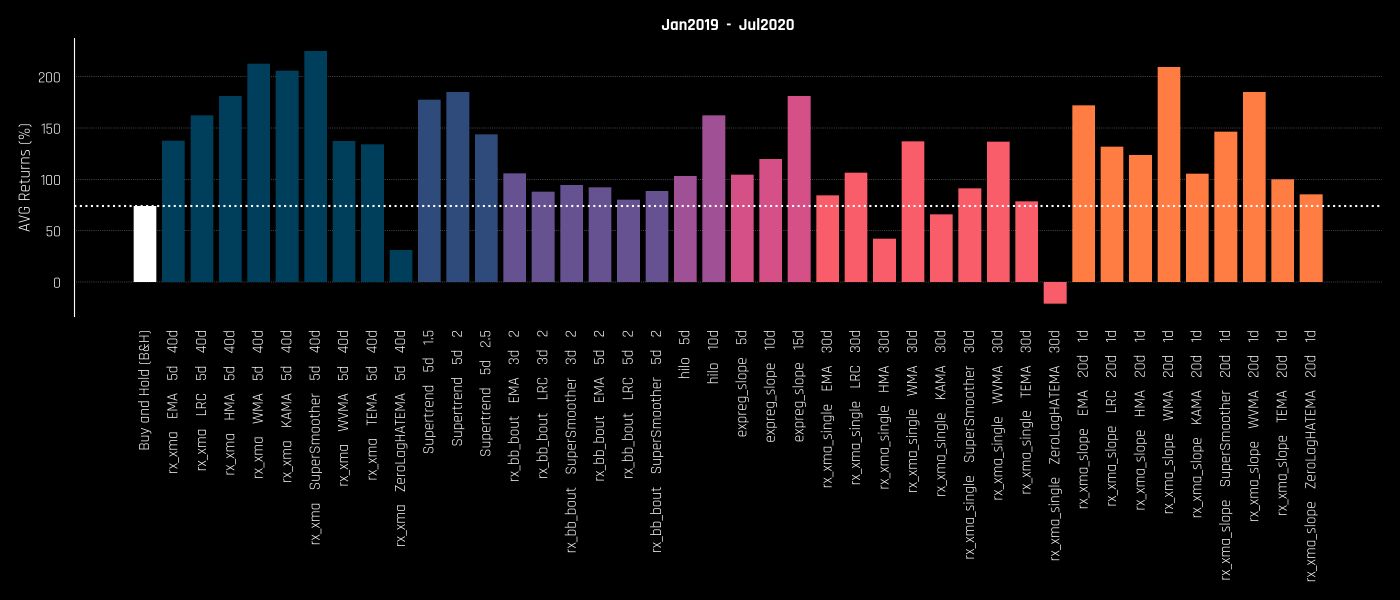

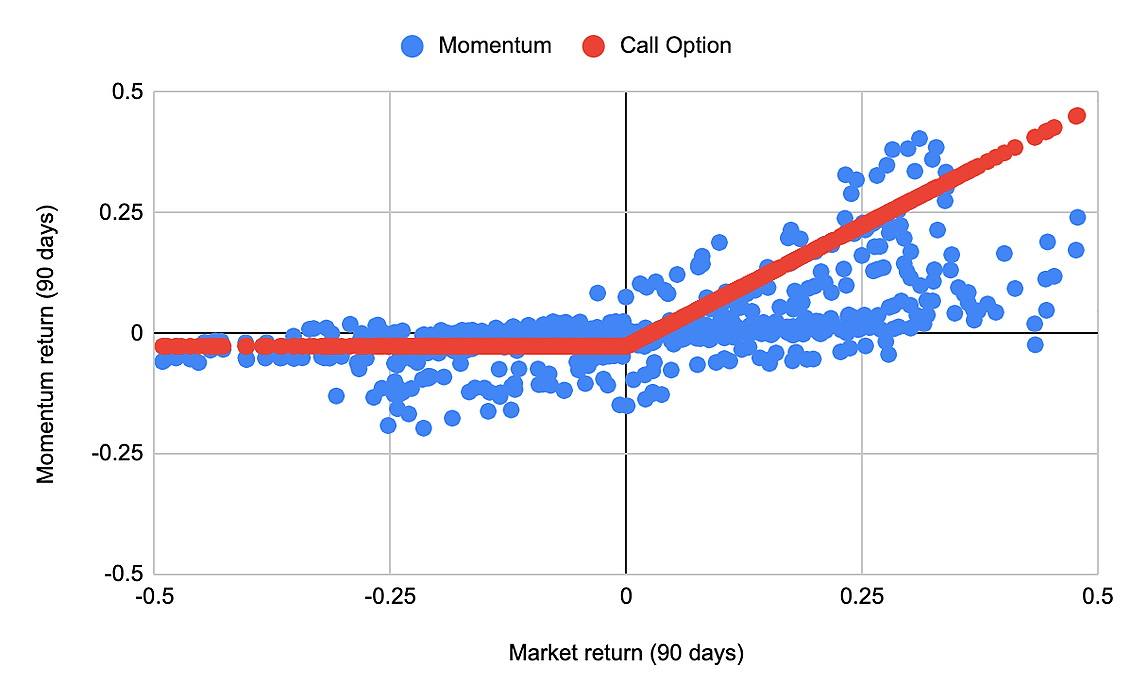

164. Is Buy and Hold Really the Best Strategy in Crypto?

There are a lot of these proverbs that get thrown around the trading community like “cut your losses short, let your winners run”, “buy the dip”, “never add to a losing trade”, “don’t try to catch a falling knife” etc. Yes, intuitively they sound about right, but how much truth there really is behind them?

There are a lot of these proverbs that get thrown around the trading community like “cut your losses short, let your winners run”, “buy the dip”, “never add to a losing trade”, “don’t try to catch a falling knife” etc. Yes, intuitively they sound about right, but how much truth there really is behind them?

165. Bitcoin Sharpe Ratio: The Risk And Reward of Investing In Cryptocurrencies

Applying the financial meter stick for evaluating risk-adjusted returns of a (digital) asset, portfolio, or strategy.

Applying the financial meter stick for evaluating risk-adjusted returns of a (digital) asset, portfolio, or strategy.

166. The Complete Guide to Stablecoins in 2019

167. Understanding The Options Greeks - Delta, Gamma, Theta, Vega, and IV.

168. Mastering Shitcoins II - The Poor Man's Guide to Getting Rich

in this follow-up to my 2017 crypto investment guide, I look back at how the portfolio did 3 years later, talk about what I’ll do differently this time.

in this follow-up to my 2017 crypto investment guide, I look back at how the portfolio did 3 years later, talk about what I’ll do differently this time.

169. The Greatest Trading Books Ever Written

{NOTE: If you’re an avid reader of mine be sure to check out my new podcast, The Daily PostHuman because everyone needs a regular dose of the future!}

{NOTE: If you’re an avid reader of mine be sure to check out my new podcast, The Daily PostHuman because everyone needs a regular dose of the future!}

170. Long Live The Dynamic NFT

Throughout 2021, ecstatic shouts of “Wagmi!” floated down the gold-plated NFT Twitter streets like Ethereum-coated confetti.

Throughout 2021, ecstatic shouts of “Wagmi!” floated down the gold-plated NFT Twitter streets like Ethereum-coated confetti.

171. Overview of the Innovative Features Brought to Financial Markets by Level01

It has become common knowledge that blockchain has immense disruptive power that allows it to push a multifaceted narrative that seems to encapsulate the entirety of the global market, especially the financial markets. While this is a given, very few startups have successfully implemented blockchain solutions targeted at a large demographic and are poised to take on a financial sector that is traditionally known to thrive on intermediate services.

It has become common knowledge that blockchain has immense disruptive power that allows it to push a multifaceted narrative that seems to encapsulate the entirety of the global market, especially the financial markets. While this is a given, very few startups have successfully implemented blockchain solutions targeted at a large demographic and are poised to take on a financial sector that is traditionally known to thrive on intermediate services.

172. Building AI-Based Trading Algorithms - An Interview with Kiran Mannam, CEO at Rocket Vault Finance

Interview with the CEO of Rocket Vault, where we discuss use of artificial intelligence in building smart trading systems.

Interview with the CEO of Rocket Vault, where we discuss use of artificial intelligence in building smart trading systems.

173. Our Next-Gen Crypto Trading Bot Neomenia Goes Live

Edit: Some Restructuring, Back in Development

Edit: Some Restructuring, Back in Development

174. A Look at PeachHub & Its Defi-Focused Trading Tools

In this post, we’ll look at Peachfolio and their PeachHub app, as well as the features available for DeFi investors.

In this post, we’ll look at Peachfolio and their PeachHub app, as well as the features available for DeFi investors.

175. How gaming with cryptocurrencies can help in the fight against COVID-19

Tauri is the Director of Casino at Bitcasino.io and co-founder of the Coingaming Group. As an early Bitcoin adopter, he has overseen the growth and development of Bitcasino from being the first licensed Bitcoin casino to an industry leader. In addition to being a crypto enthusiast, he also enjoys the occasional poker game.

Tauri is the Director of Casino at Bitcasino.io and co-founder of the Coingaming Group. As an early Bitcoin adopter, he has overseen the growth and development of Bitcasino from being the first licensed Bitcoin casino to an industry leader. In addition to being a crypto enthusiast, he also enjoys the occasional poker game.

176. "Free Market will Adopt the Best Form of Money, and Bitcoin Checks all the Boxes" - Carl Runefelt

In a bid to help crypto enthusiasts with more insight and information, I reached out to Carl Runefelt, a crypto influencer, for his opinion and expert insights.

In a bid to help crypto enthusiasts with more insight and information, I reached out to Carl Runefelt, a crypto influencer, for his opinion and expert insights.

177. The first blockchain-funded COVID vaccine: An interview with George Mac, CEO of KELTA

When the world went into lockdown in March, the blockchain event industry ground to a halt, and then switched to the online format. Fast-forward six months, and the first post-lockdown offline events are already being scheduled. We've chatted with George Mac – CEO of the mining platform KELTA – and the man behind the upcoming SLOBLOCO congress in Bratislava, Slovakia.

When the world went into lockdown in March, the blockchain event industry ground to a halt, and then switched to the online format. Fast-forward six months, and the first post-lockdown offline events are already being scheduled. We've chatted with George Mac – CEO of the mining platform KELTA – and the man behind the upcoming SLOBLOCO congress in Bratislava, Slovakia.

178. IEO and Trading Bots to Help You Win Each Battle

Post by Tim Kozak, Head of Technology at Intellectsoft Blockchain Lab

Post by Tim Kozak, Head of Technology at Intellectsoft Blockchain Lab

179. The Key to Turning Crypto Into a Trillion Dollar Industry is Trust

The interest in crypto-derivatives has gained substantial momentum among investors and traders since the introduction of the Chicago Board Options Exchange (CBOE) and the Chicago Mercantile Exchange (CME) in late 2017. Crypto derivatives trading volume soared by 58 percent as compared to the prior month. The monthly volume reached $712bn in August, sufficient to surpass the previous high of $602bn registered in May 2020. Huobi, OKEx, BitMEX, and Binance registered a volume of $208 billion, $190 billion, $72 billion, and $184 billion, respectively.

The interest in crypto-derivatives has gained substantial momentum among investors and traders since the introduction of the Chicago Board Options Exchange (CBOE) and the Chicago Mercantile Exchange (CME) in late 2017. Crypto derivatives trading volume soared by 58 percent as compared to the prior month. The monthly volume reached $712bn in August, sufficient to surpass the previous high of $602bn registered in May 2020. Huobi, OKEx, BitMEX, and Binance registered a volume of $208 billion, $190 billion, $72 billion, and $184 billion, respectively.

180. What Crypto Novelties Should We Expect in 2020?

Every year Cryptocurrency Market keeps attracting the attention and trust of masses. Mostly, people divide into two camps: those who trust in crypto, and skeptics, who keep saying that “sweet 2017” will never happen to cryptocurrencies again.

Every year Cryptocurrency Market keeps attracting the attention and trust of masses. Mostly, people divide into two camps: those who trust in crypto, and skeptics, who keep saying that “sweet 2017” will never happen to cryptocurrencies again.

Firstly, let’s summarize what the past 2019 year led to.

The Six Main Crypto-Market Changes During 2019:

181. Bitcoin Bull Market: Comparing 2020 against 2016

The uptrend period when Bitcoin approached $ 18,000 and what's going on reminds us of Cycle Theory in the past, as well as the uptrend of 2016 - 2017, simply because the market could change. change, but human psychology is the same. We will look back at the two phases: 2016-2017 and the current period, so that investors can draw their own conclusions about what to do when the market is in the FOMO phase.

The uptrend period when Bitcoin approached $ 18,000 and what's going on reminds us of Cycle Theory in the past, as well as the uptrend of 2016 - 2017, simply because the market could change. change, but human psychology is the same. We will look back at the two phases: 2016-2017 and the current period, so that investors can draw their own conclusions about what to do when the market is in the FOMO phase.

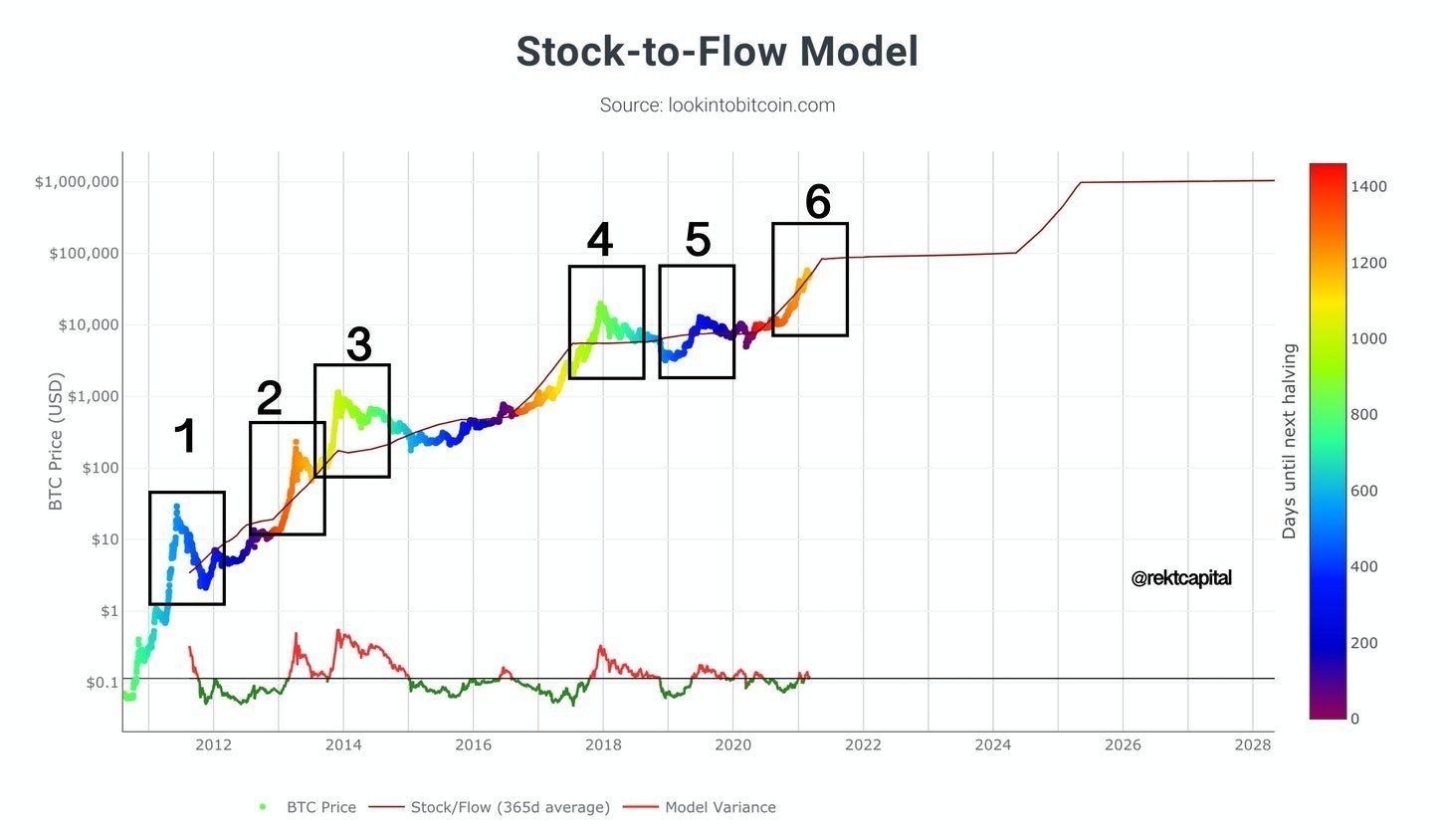

182. Measuring The Bitcoin Peak Using Data Science: Stock-To-Flow Deviations - Part 1

Bitcoin price deviations from the Stock to Flow line - whether to the upside or to the downside - that have preceded Bear Market bottoms

Bitcoin price deviations from the Stock to Flow line - whether to the upside or to the downside - that have preceded Bear Market bottoms

183. A Peek Into the Arsenal of Crypto Day Traders

Abhijoy and I have always been fascinated by the world of cryptocurrency trading, often wondering how our lives would shape out if we seriously considered trading as a vocation.

Abhijoy and I have always been fascinated by the world of cryptocurrency trading, often wondering how our lives would shape out if we seriously considered trading as a vocation.

184. 4 Gold-Backed Tokens to Fight Crypto Volatility

Thanks to gold-pegged assets, crypto investors may fight the market’s volatility. Below are four gold-backed tokens that could help you do the same.

Thanks to gold-pegged assets, crypto investors may fight the market’s volatility. Below are four gold-backed tokens that could help you do the same.

185. 10 Bold Ideas I Learned from Interviewing 20+ Traders

186. Trading Crypto When Charts Fail: How To Use Elliott Waves and Fibonacci Retracement Instead

In this article, we dive deep into the advanced concepts and techniques employed in the technical analysis of cryptocurrencies. We'll be witnessing how the market moves in waves, as a whole, and on all other levels as well, through our analysis of advanced methods like Elliott Wave theory, Fibonacci Retracement, and much more.

In this article, we dive deep into the advanced concepts and techniques employed in the technical analysis of cryptocurrencies. We'll be witnessing how the market moves in waves, as a whole, and on all other levels as well, through our analysis of advanced methods like Elliott Wave theory, Fibonacci Retracement, and much more.

187. Margin Trading: What You Don't Think About Today Will Bite You Hard Tomorrow

How many chats on your phone are discussing where the Bitcoin price is heading right now? Even if you only touch the crypto industry with your left pinky, the Bitcoin price talk is hard to miss. Add to this the stories about someone who always seems to forecast the price right. A friend of a friend who moved to Bali and now makes a ton of money by trading straight out of his pool. The wizard sees in the price charts what others don’t see and makes profits when the markets are good, bad, and even ugly.

How many chats on your phone are discussing where the Bitcoin price is heading right now? Even if you only touch the crypto industry with your left pinky, the Bitcoin price talk is hard to miss. Add to this the stories about someone who always seems to forecast the price right. A friend of a friend who moved to Bali and now makes a ton of money by trading straight out of his pool. The wizard sees in the price charts what others don’t see and makes profits when the markets are good, bad, and even ugly.

188. Applying Machine Learning to Crypto-Sphere: The Good and the Bad Aspects

Anyone who has traded cryptocurrencies or invested in Bitcoin stocks before has been frustrated by the difficulty involved with trying to predict market trends.

Anyone who has traded cryptocurrencies or invested in Bitcoin stocks before has been frustrated by the difficulty involved with trying to predict market trends.

189. Concurrent Scalping Algo Using Async Python [A How To Guide]

Automating My Manual Scalping Trading Strategy

Automating My Manual Scalping Trading Strategy

190. What is a Copy Trading Platform and Why We Need One for Cryptocurrencies?

Copy trading is often confused with social trading, but they differ largely from each other.

Copy trading is often confused with social trading, but they differ largely from each other.

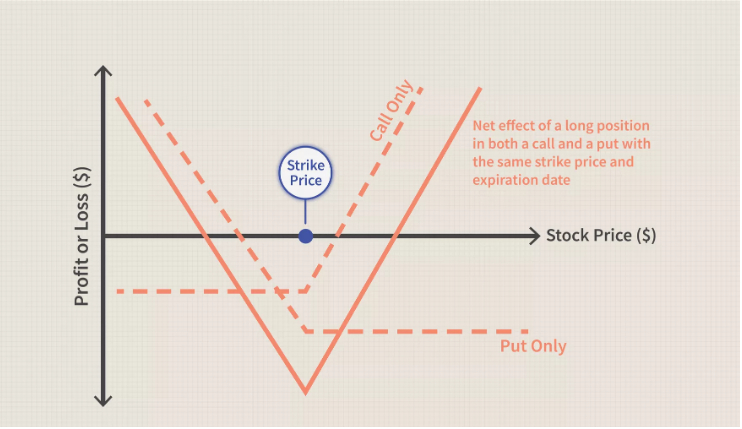

191. (Almost) Risk-Free Futures Trading by Leveraging Options

Introduction

Introduction